Capitalism Works

Post #1488

Imagine being alive 80,000 years ago in central Africa. As a human being wandering through the jungle, you could lose your life if you accidentally got too close to a group of gorillas, and the 600-lb, silverback gorilla decided that you had “crossed the line.” A 150-lb human being is no match for a 600-lb gorilla.

But if that is so, and other examples abound, then how did humans survive?

Humans survived — even when they had no chance, physically, to prevent their own extinction — because they have a unique talent, the ability to engage in rational thought and use concepts. Being able to engage in rational deliberation and use concepts, humans have an edge over the animals of the world.

It explains how we survived.

Early on, it was discovered that we did not just need consumed goods, such as what you get when you collect nuts and berries and consume them. Early humans began to realize that we need “unconsumed goods” — i.e., what economists now call “capital goods.” Capital goods are tools, machines, shelters, and many other inventions.

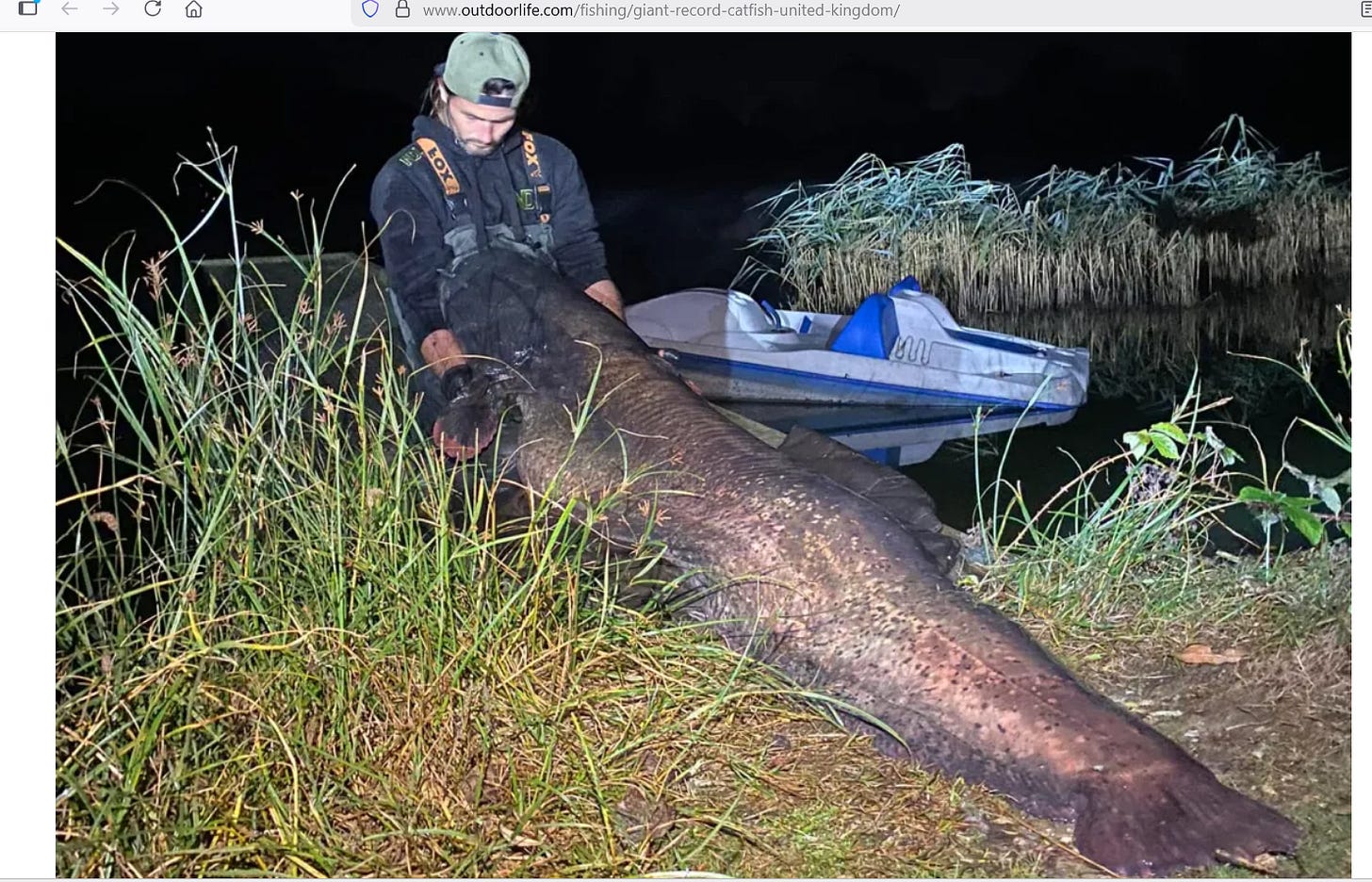

Once it is discovered that there are 150-lb catfish in a river nearby, rational thought and concepts will reveal that you will not be able to wrestle them out of the water, physically. Here is what one looks like:

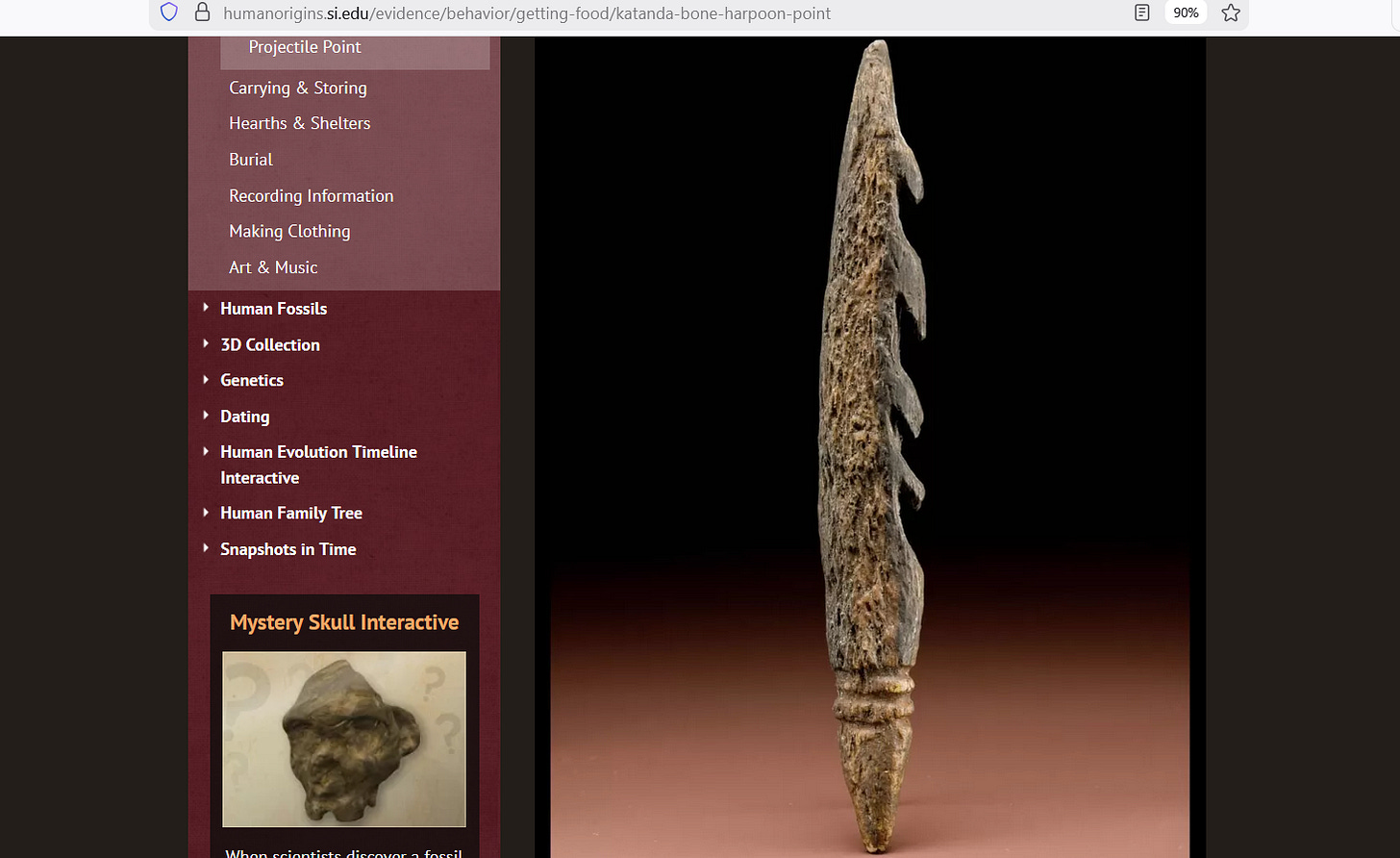

As you can tell, you would have no chance against such a beast if using your bare hands. But if you use rational thought and concepts, then you could invent a barbed spear, like this one, dated to at least 80,000 years ago:

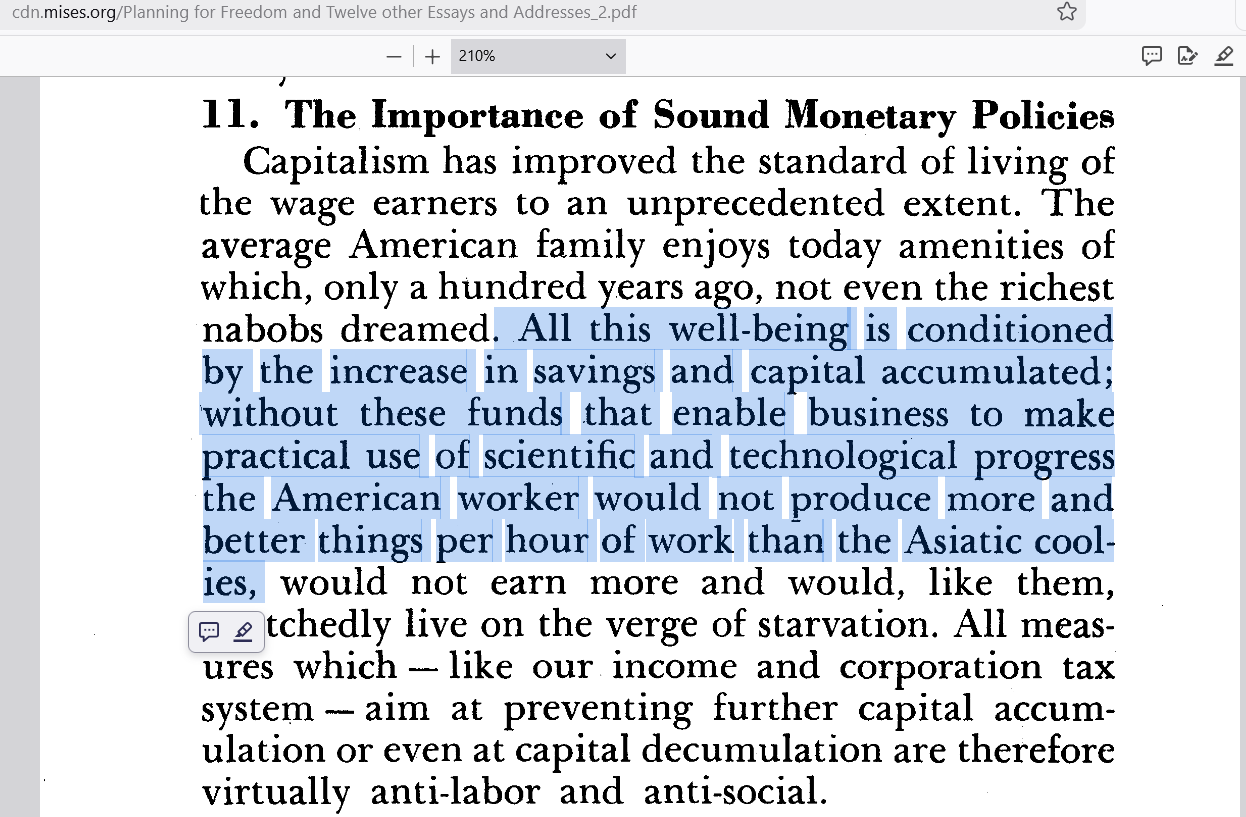

Because you used some of your time and energy to create an “unconsumed good” (a capital good), you can now feed your entire tribe for 2 days (from that caught catfish). On the third day, you could go out again, feeding the entire tribe again — all because of the accumulation of capital (the origin of wealth). Here is Mises on this point:

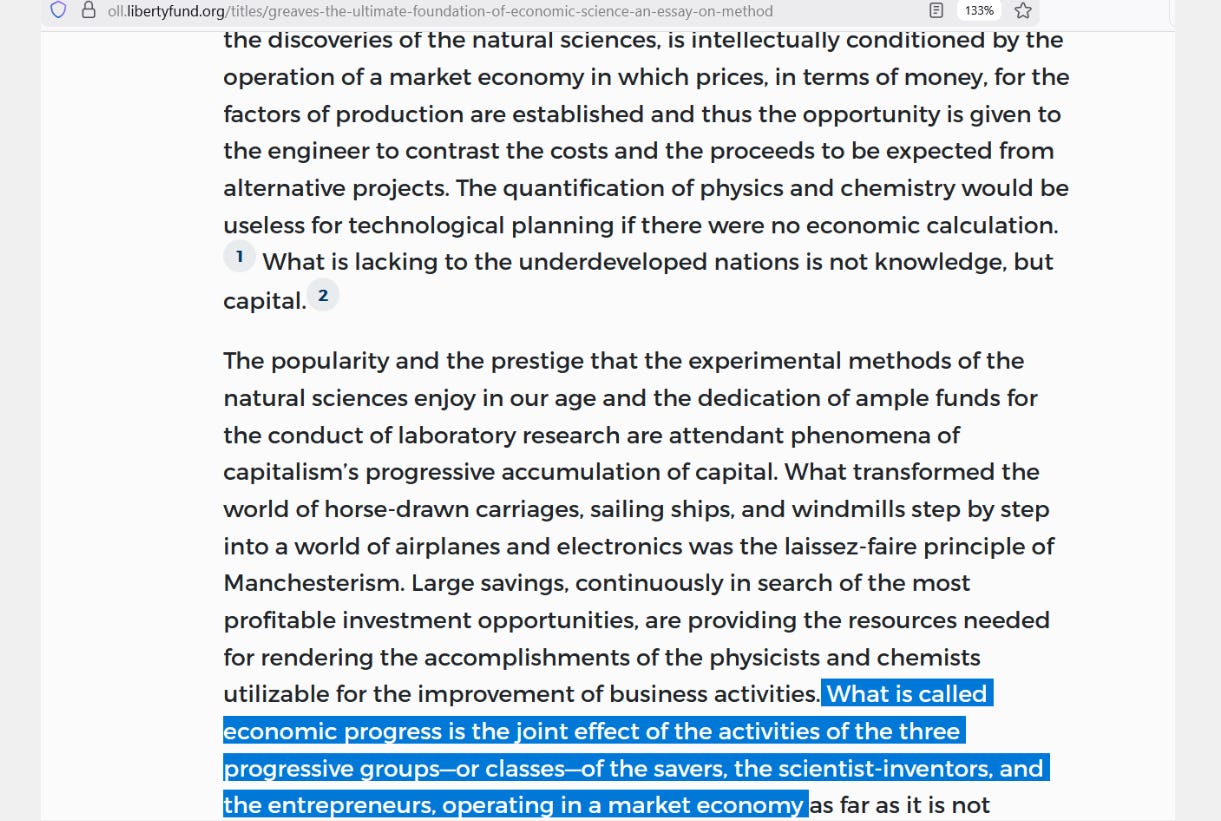

Our well-being requires savings, and it requires capital (unconsumed goods). In a later essay, Mises makes it clear that economic progress requires 3 archetypes or 3 kinds of human beings (those with particular propensities), and it requires all 3 of them being left alone and unfettered by the government:

Progress, in short, requires savers, scientists, and entrepreneurs. When governments engage in deficit spending, it harms savers. When governments regulate businesses, it harms entrepreneurs. Spending and regulation by government tends to be harmful, overall. But censorship, even if farmed out to a private entity, harms scientific progress.

Michael Shellenberger recently gave a talk, at the Patriots for Europe Foundation, about how, in just 3 short years, we can lose all genuine digital communication with each other — if bad guys get control the internet:

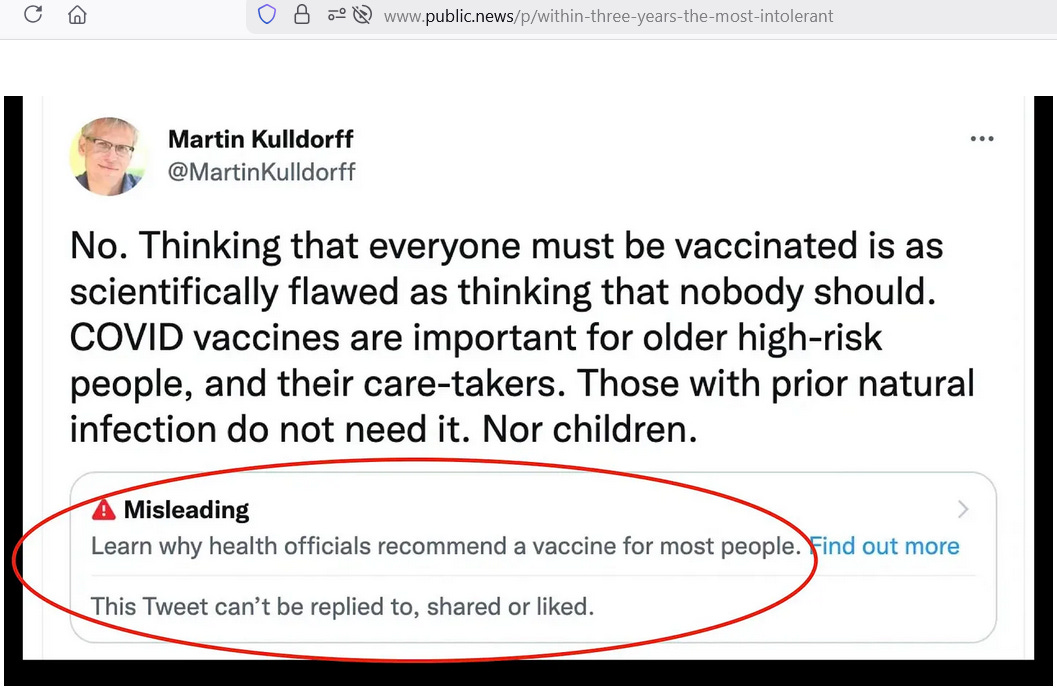

In this screenshot from his presentation, he showed how Twitter, in 2021, kept government health officials from having to debate and prove the merits of their policies. Martin Kulldorff’s views were restricted in digital space, so that they could not gain the usual momentum that communicated truth gains without censorship.

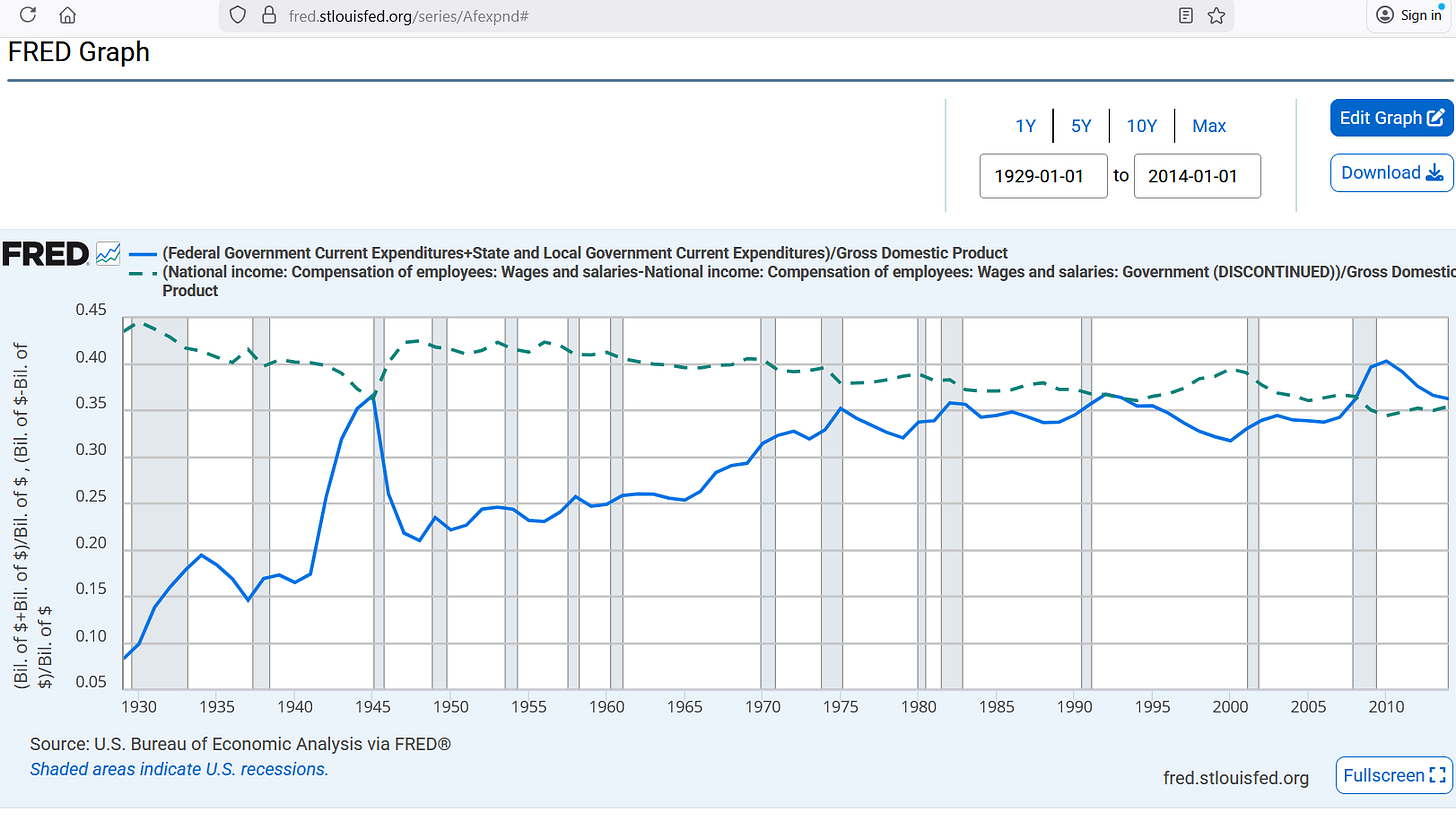

To find out how far a nation has drifted away from free market (unregulated) capitalism, you can graph the sum of all private wages earned (dashed line) against the sum of all levels of government spending (solid blue line), because those values indicate the share of resources allocated centrally vs. the share allocated by the many:

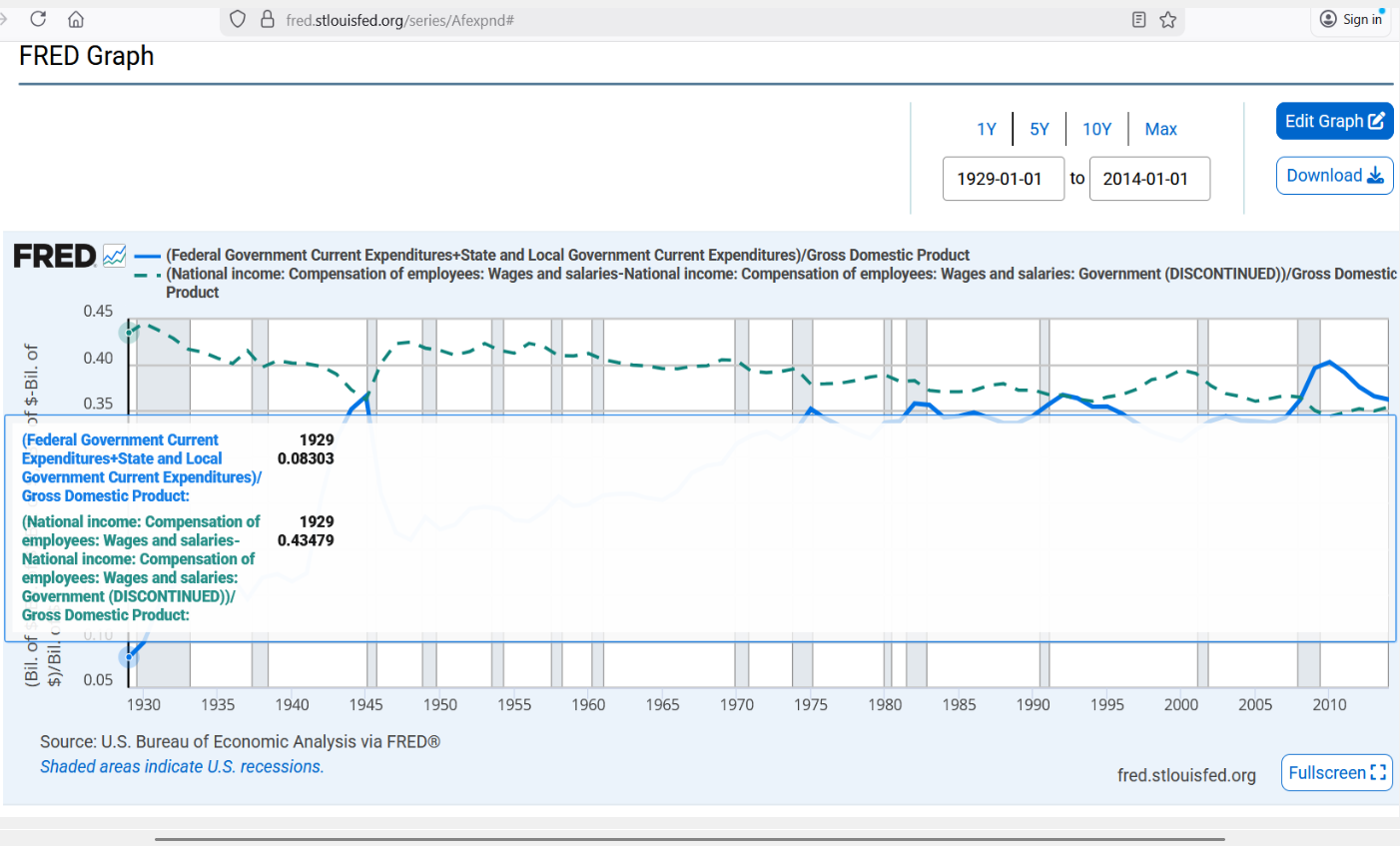

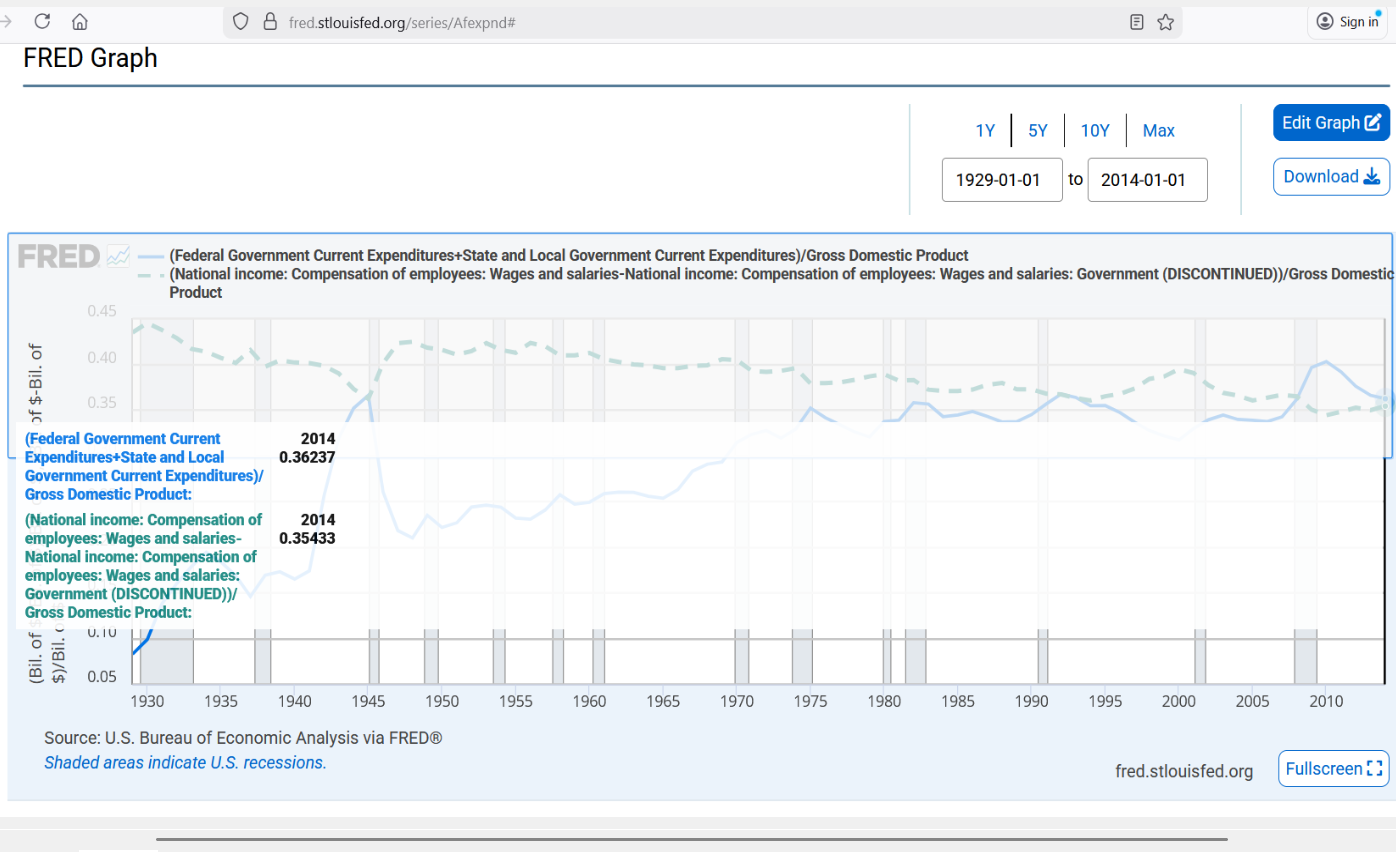

Back in 1929, we had capitalism, and private wages comprised over 40% of GDP, while all levels of government spending were lower than 10% of GDP. But by 2010, we had “socialism” — where government allocation of resources (spending) was even more than the allocation of resources by over 100 million private sector workers.

1929

2014

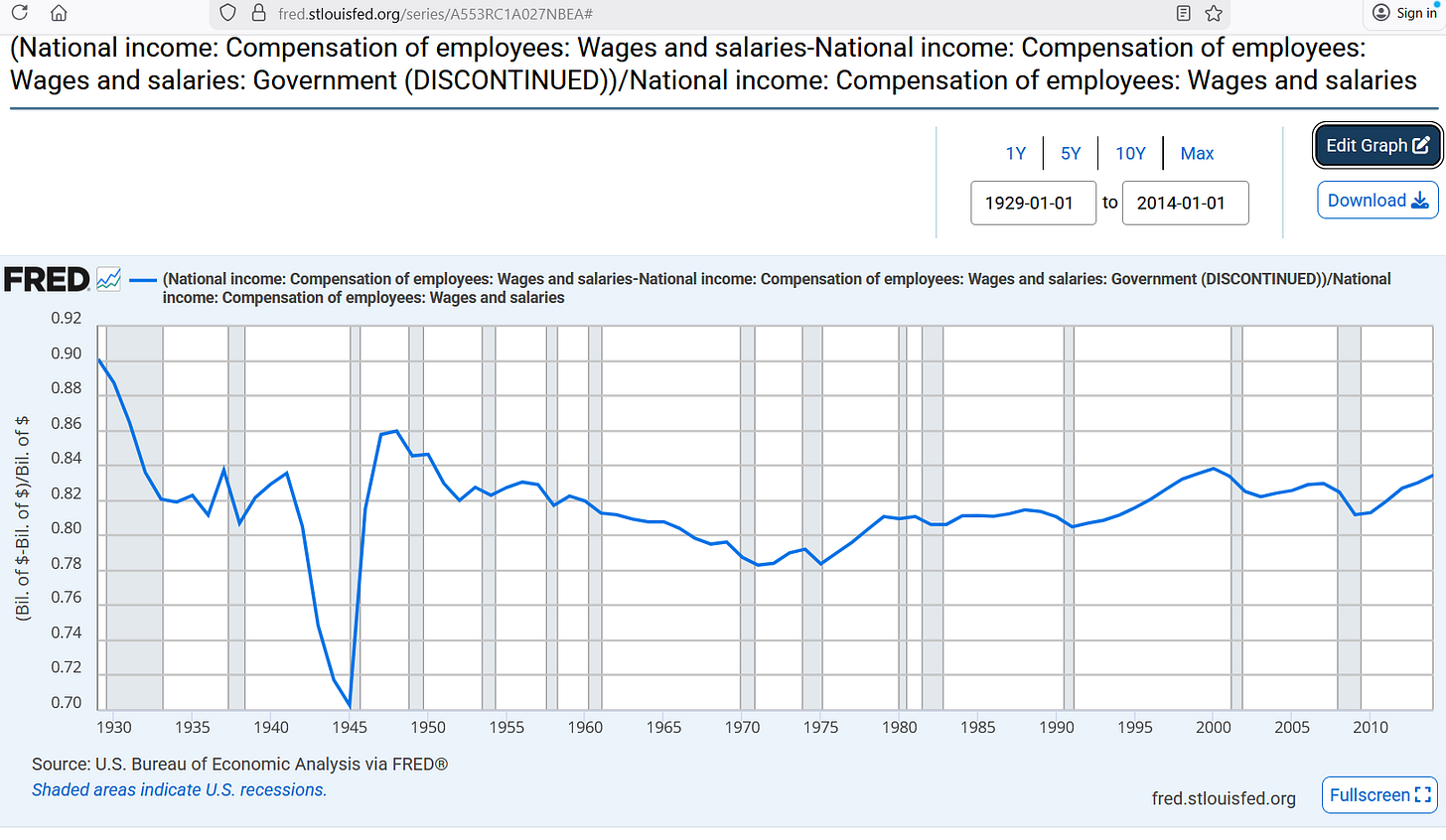

One way to know if capitalism has been restored in America would be to once again find out that private sector wages were 90% of all wages paid (all wages = public employees + private employees):

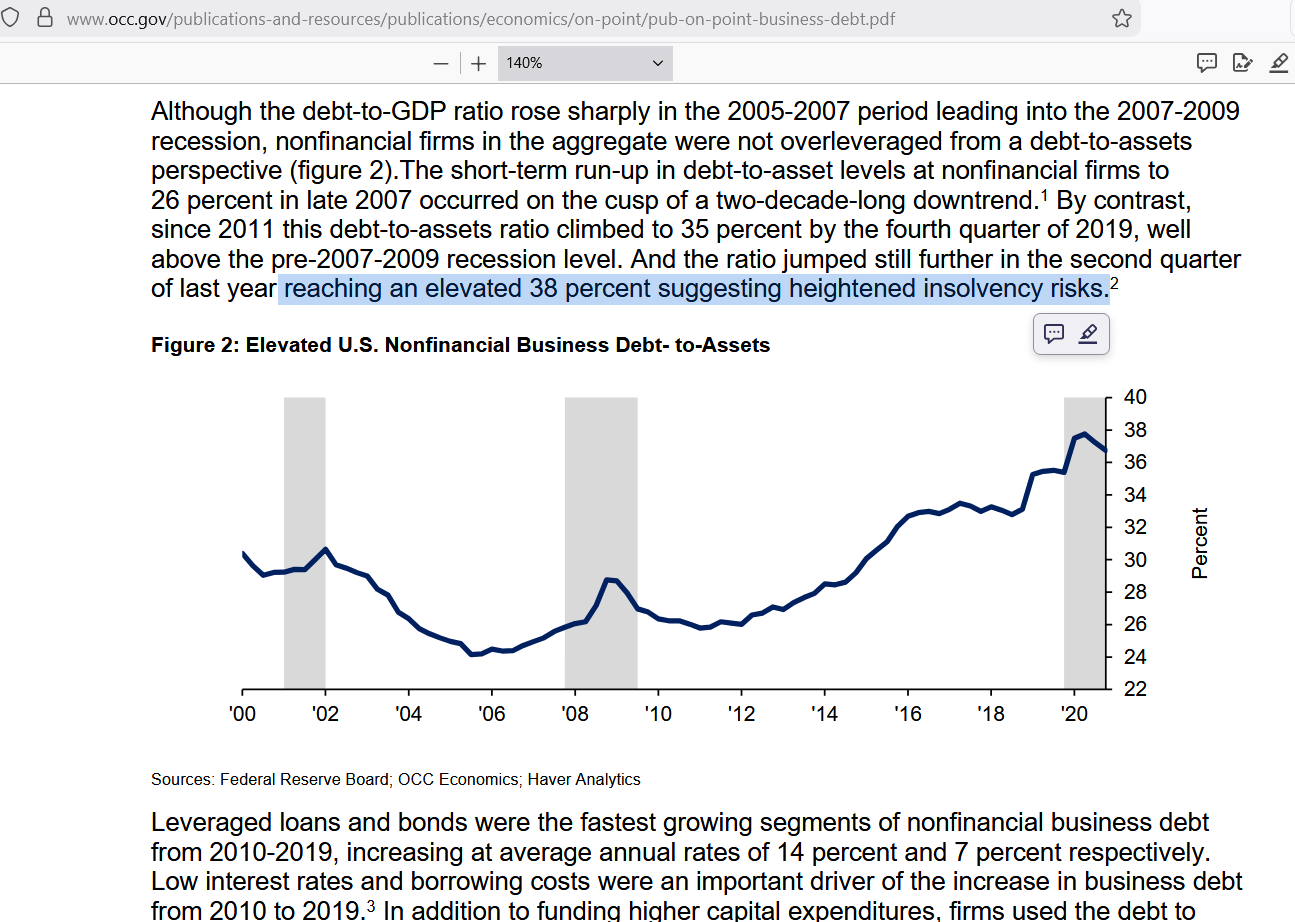

Private wages in 2014 were not even 84% of all wages paid out, indicating that much reform is necessary. Rising debt is another indicator that we have drifted away from capitalism, and the debt-to-asset ratio of companies is getting too high, increasing the risk that businesses will go financially insolvent (bankrupt) at the next negative shock:

Let’s hope for a return to the ideals which governed our nation for the first 140 years, from 1789 to 1929, so that we can once again look forward to a bright future.

Reference

[150-lb catfish are too big to wrestle out of the water with your bare hands] — https://www.outdoorlife.com/fishing/giant-record-catfish-united-kingdom/

[barbed spears were made at least 80,000 years ago] — https://humanorigins.si.edu/evidence/behavior/getting-food/katanda-bone-harpoon-point

[savings and capital are required for well-being] — https://cdn.mises.org/Planning%20for%20Freedom%20and%20Twelve%20other%20Essays%20and%20Addresses_2.pdf

[progress requires not getting in the way of savers, scientists, and entrepreneurs] — https://oll.libertyfund.org/titles/greaves-the-ultimate-foundation-of-economic-science-an-essay-on-method

Econ series:

U.S. Bureau of Economic Analysis, Federal Government Current Expenditures [AFEXPND], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/AFEXPND

U.S. Bureau of Economic Analysis, State and Local Government Current Expenditures [ASLEXPND], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ASLEXPND

U.S. Bureau of Economic Analysis, Gross Domestic Product [GDPA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPA

U.S. Bureau of Economic Analysis, National income: Compensation of employees: Wages and salaries [A034RC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A034RC1A027NBEA

U.S. Bureau of Economic Analysis, National income: Compensation of employees: Wages and salaries: Government (DISCONTINUED) [A553RC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A553RC1A027NBEA

[average corporate debt at 38% of assets, even if stock is already overvalued] — https://www.occ.gov/publications-and-resources/publications/economics/on-point/pub-on-point-business-debt.pdf

Interesting how ancient harpoons show how capital goods unlock resources otherwise unreachable. That jump from consumed goods to unconsumed goods is kinda the backbone of every economic system. I spent time studying low-tech fishing societies once and the pattern you describe holds everywere, where the initial sacrifice of effort to build tools always pays huge dividends downstream if coordinated properly.