NOTE: This post is inspired by a Mises Institute essay.

The USA was tricked into having a central bank by a crisis manufactured in 1907 by two speculators, Heinz and Morse, who attempted to corner the copper market. Banks and trusts — i.e., non-bank financial intermediaries that kept minimal reserves, such as 5% — which were associated with these two men, failed. J.P. Morgan wouldn’t help.

Short version: Because of two dumb speculators, we ended up with a central bank.

After the Panic of 1907 — which, I remind you, was caused by two dumb people — we got the Aldrich-Vreeland Act, which set up the National Monetary Commission, a commission which, later on, unilaterally decided that the United States was going to need a central bank. By 1971, we were entirely off of the gold standard.

But when central banks print money, those closest to banking get richer. It’s not just bankers, but anyone trading in securities and even in equities in the stock market. In other words, all top-dogs get more rich when money is printed. This phenomenon is called a Cantillon Effect, from Richard Cantillon: the first to get the money wins.

The first person to receive printed money is immediately richer, and the prices of things have not gone up, and they won’t go up, until that first person has spent the cash and made themselves more wealthy in the process. After that, prices begin to rise, so that the next people to receive that printed cash do not gain as much.

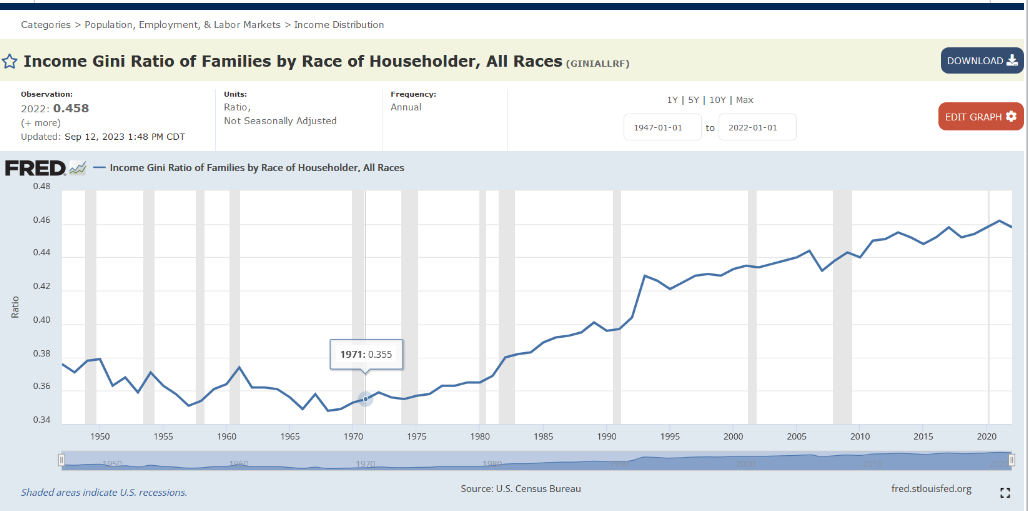

This widens wealth inequality. Check out the trend of income inequality, as measured by the gini coefficient, both when there was a gold standard (pre-1971) and when there was total fiat currency (1971-present):

Can you see the subtle, downward trend in inequality prior to 1971, and then the steeper rise in inequality after the gold standard was fully removed and the flood gates were left open for wanton money printing? Gee, I wonder why that might have occurred? Could it be that the top-dogs get outsized benefits from money printing?

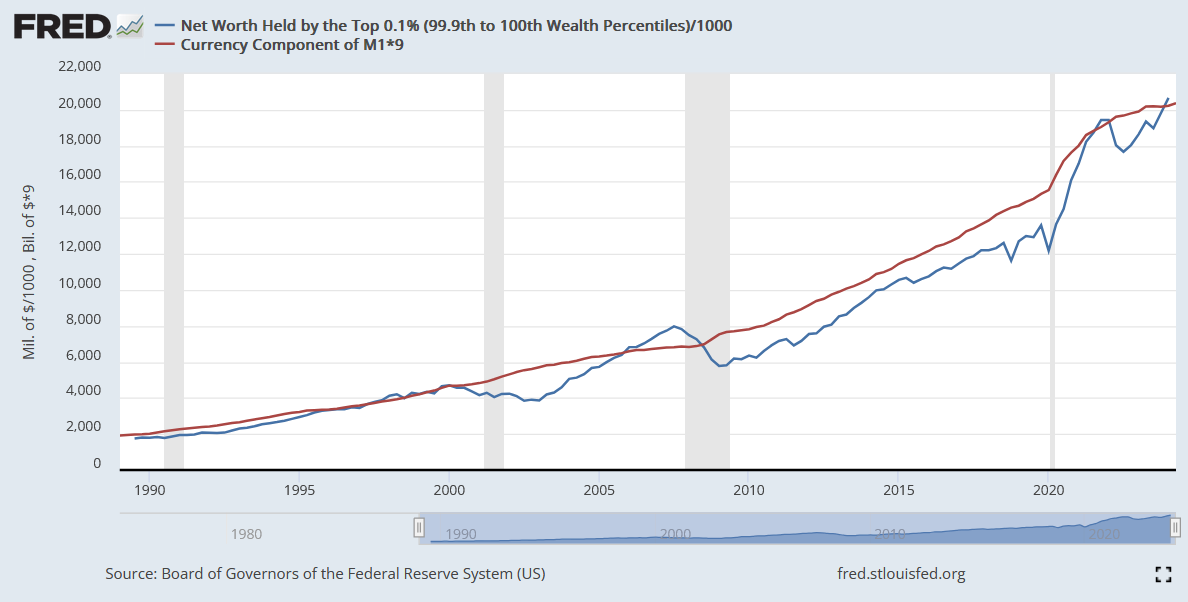

If we print money for long enough, then those top-dogs will own the entire economy, forcing the rest of us into chattel slavery just to get by, living a hand-to-mouth existence. For those needing clarification on how it is possible that top-dogs get outsized benefit, take a look at how close top wealth tracks with total hard currency:

The red line is the total amount of circulating currency in the form of dollar bills and coins, but it has been multiplied by a factor of nine and something very strange then happens: It almost perfectly tracks with the wealth held by the top 0.1% of us (blue). Hmm.

Faster printed money = more held wealth by top 0.1%.

This same, tight relationship isn’t true for the working class poor, those who exist on a socioeconomic level that is below the middle class. Note how the currency is not multiplied by anything to give this comparison:

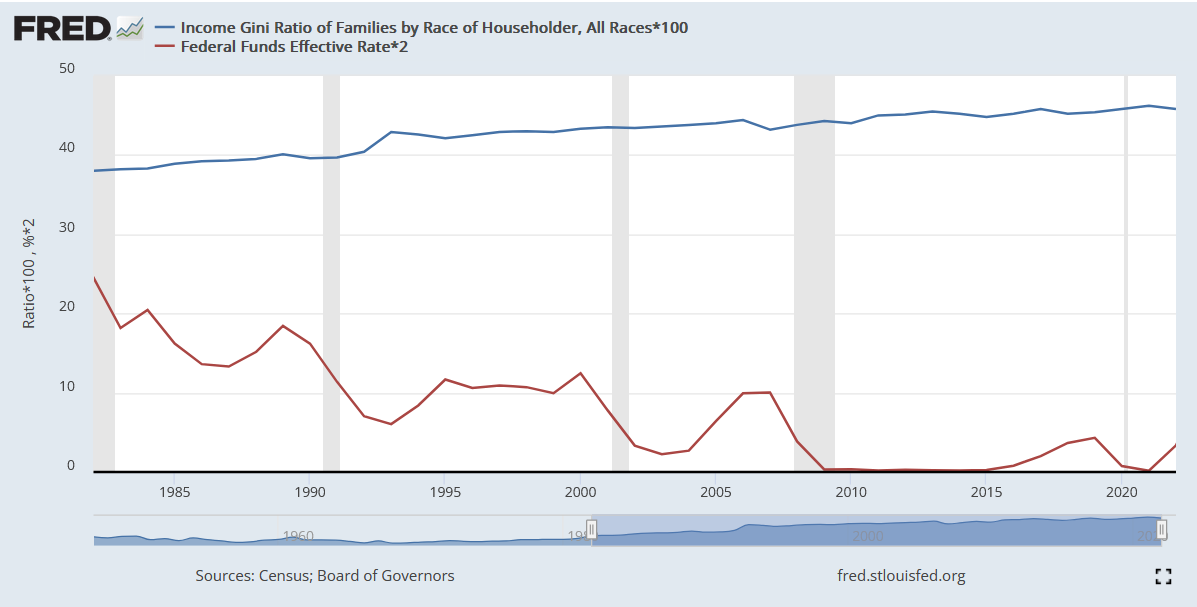

When the Federal Reserve wants to inject money into the system, it buys bonds and uses “new money” to purchase them, sending that new money into the banking system. This lowers the interest rate, and the result shows up in a series of the federal funds rate (the rate banks pay each other for very short-term, interbank loans).

But look at how that “cheap money” policy tracks along with income inequality:

The red line shows interest rates (multiplied by two for easier comparision) and they are dropping as the Federal Reserve injects more and more cash into the system. The blue line is moving up as the red line drops, and the blue line is the inequality.

Evidence suggests that central banks cause inequality in society, and that a return to the sound money of a system of free market capitalism would reverse the inequality.

Reference

[Panic of 1907, caused by two speculators, ultimately leads to Federal Reserve Act] — https://www.federalreservehistory.org/essays/panic-of-1907

Plummer's Tragedy and Hope 101 is recommended reading (or listening on Odysea) for more on the central bank and the "innovation" of income taxes, how Woodrow Wilson was a patsy used by the elites to push this all through, and much more.

Great work. Recommended on my Substack.