In computing the fallout of the decisions made by bureaucrats adopting “Net Zero” policies regarding greenhouse gas emissions, researchers discovered that everyday people will become 15% more poor (their living standard lowered by 15%) for the 30 years from 2030 to 2060.

After that, regular people will remain 10% more poor.

These lowered living standards would amount to a “Great Reset”

Keep in mind that the “climate scare” serves well as a useful cover-up for the fallout of the economic decisions of bureaucrats: infringing on economic freedom with socialist public policy reduces wealth creation (creates more poverty).

You never have to have that discussion about the government being too large, if the poverty around you is thought to come from adopted climate policy — rather than the originally-adopted socialist policies of big government interference into, and partnership with, the private sector.

But we cannot afford such new investments as “Net Zero” — and elites may actually like that we can’t afford it, because the pain which comes from investing in it hides the pain of prior socialist investments. We currently cannot even afford to pay for our typical investments:

The red area is net savings, out of which investments can get funded. The blue area are the investments. It used to be the case that more than $1 out of every $2 invested had been saved up prior to that investment.

Most of investment had been paid for by prior savings (equity financing).

But currently, not even $1 in every $11 invested came from prior savings, meaning that the only way to continue investing by that much is to sell the rights to your future income stream (debt financing).

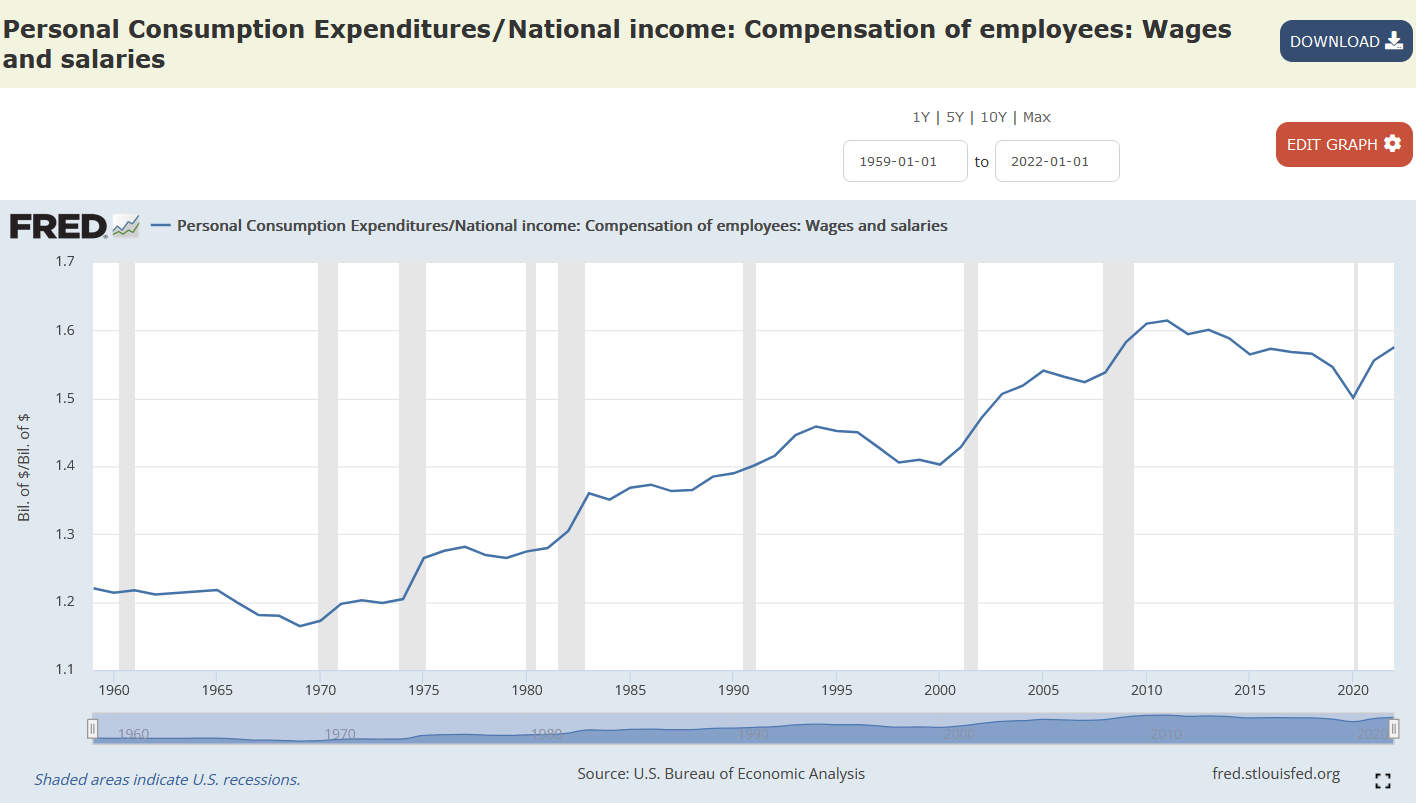

Because government is picking winners and losers more, the wage share of GDP is dropping:

People used to spend 20% more than their total salaries, because other income streams — such as interest from personal investments — covered the 20% difference. But with government crowding out the private sector, interfering with economic freedom, people are having to spend 60% more than their salary:

In other words, the extra 40% of spending is getting borrowed (e.g., putting your grocery bill on a credit card, because you cannot afford to pay cash for food) or redistributed by government. But that increases the debt leverage of the entire nation (horizontal threshold added):

Equity is that portion of assets which is debt-free (i.e., fully-owned). Another name for it is wealth. Industrial firms are considered to be “over-leveraged” if their debt is over 33% of their equity. As the graph shows, U.S. debt is over 50% of U.S. equity.

The disturbing part about the elites behind the “climate scare” is that they likely have this information about how green policies will “break our bank” — but they press on, regardless. They plan to benefit from the ensuing chaos and hardship.