When engaged in productive activity, you can either attempt to make more money or more things. What economists call the “real economy” is the economy of things. Money is an important part of an economy, as it enables high rates of economic interaction, but money — without things — is useless (worthless).

The financial sector is the only economic sector which should have regulations.

Consumer advocacy outfits and competition are all that is needed for the other sectors — the non-financial sectors of the economy which produce real things — because unfair and unsafe practices cannot remain popular in a free market.

But unfair and unsafe financial practices are ephemeral enough where conventional methods of restoring fairness and safety fail. Bad money drives out good money (Gresham’s Law).

Financial Unfairness

An example of unfairness would be for the government to print money and give it to a bank. The bank gets the new money at full value but, by the time the new money reaches new hands, the new money has caused the prices to rise — so the banks (the makers of money) get outsized benefits compared to the producers (the makers of things).

This is called the Cantillon Effect of newly-printed money.

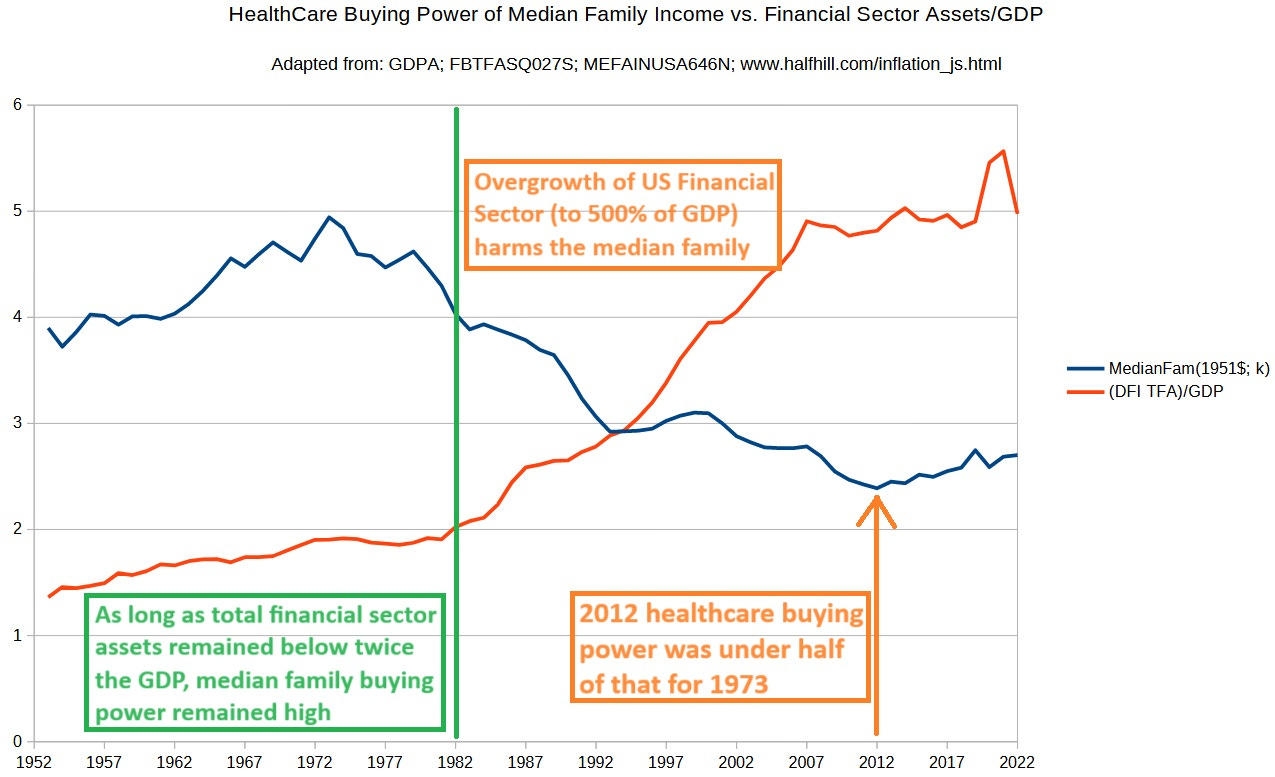

This unfairness is also unsafe, because it leads to hyper-financialization, where banks make up too high of a percentage of the economy. With comparatively less people making things, material wealth erodes — while paper wealth for the finance moguls skyrockets.

But this reduces real savings, out of which investments are born. Eventually, there are not enough savings to grow capital, let alone to offset capital depreciation. That means that there are no longer enough goods and services to go around, and their prices rise proportionally — until a typical family cannot afford a living standard:

At this point, one of two paths can be taken:

restore economic freedom (even if finance moguls hate it, and try to thwart you)

attempt a Great Reset (where a caste system is enshrined into law)

The finance moguls would like to return to the days of feudalism (aka Great Reset), where a few property owners lord over the masses, who must work the land owned by the baron in order to eat and to pay rent for a roof over their heads.

Instead of letting moguls rule, we should fight with all our might against a Great Reset. This means even fighting the stepping stones which lead directly to a Great Reset, such as “carbon footprints” and “ESG” and “vaccine passports” and Central Bank Digital Currencies (CBDC’s).

Reference

[Medical-Care Price Index] — Tom’s Inflation Calculator. https://www.halfhill.com/inflation_js.html

[median family income] —U.S. Census Bureau, Median Family Income in the United States [MEFAINUSA646N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MEFAINUSA646N

[US GDP] — U.S. Bureau of Economic Analysis, Gross Domestic Product [GDPA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPA

[US Financial Sector Size (Assets)] — Board of Governors of the Federal Reserve System (US), Domestic Financial Sectors; Total Financial Assets, Level [FBTFASQ027S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FBTFASQ027S

Great post. Short and sweet and comprehensible.