According to The Transparency Project from the Reason Foundation, there were 26 states that had growth in liabilities between 2020 and 2022. After analyzing the data further, I found 7 states with at least 10% yearly debt growth — or “double-digit debt growth” (DDDG) — marked in orange below:

But that rate of growth in state government liability is not sustainable, because nominal incomes for the last 14 years or so (2010-2023) grew by an average of under 5% a year:

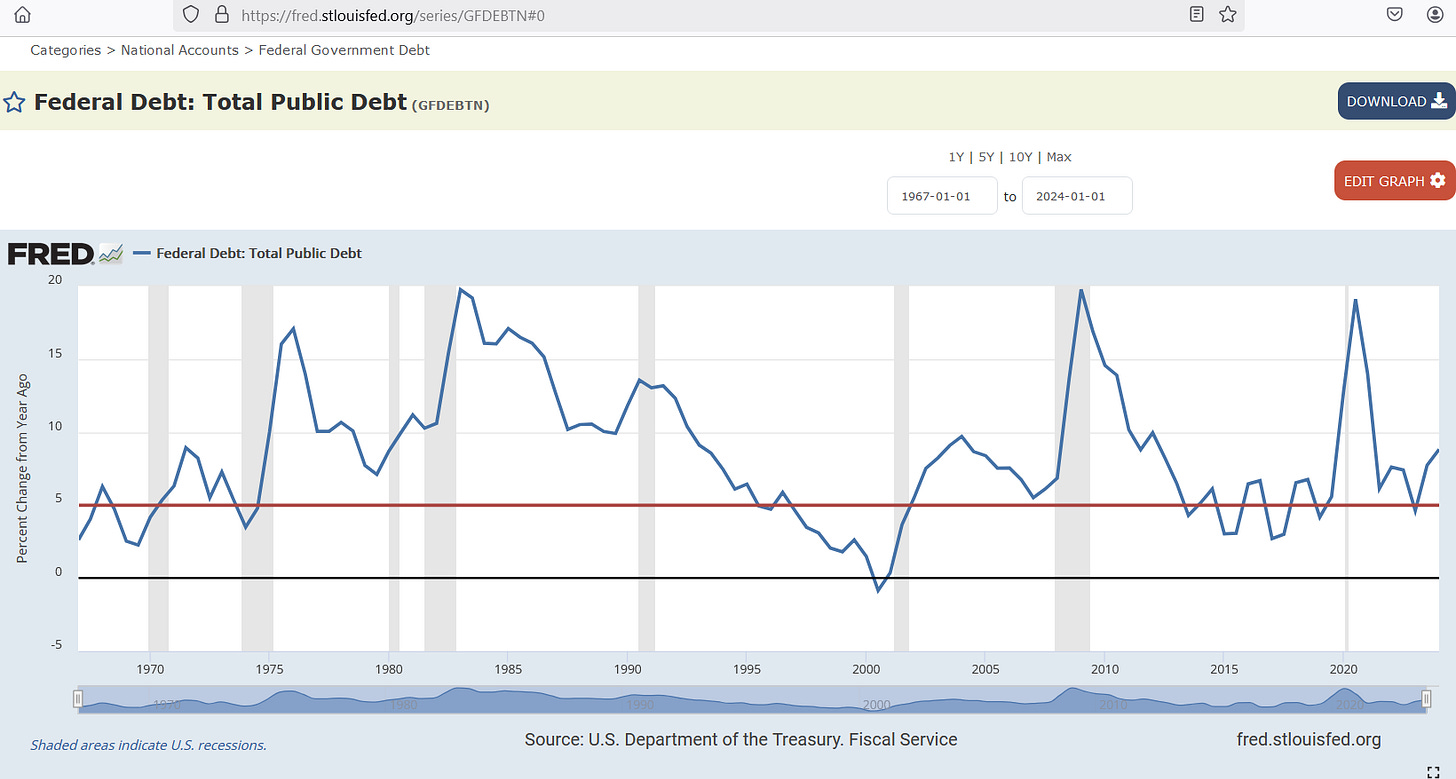

If you are adding liabilities at a rate that is more than twice as fast as the rate that you are adding income, then you are in for a negative shock in the future — a day of reckoning. The federal government since 2010 has an average rate of growth in debt that is well over 5% a year:

This has resulted in the phenomenal situation where each civilian of age 16 and over has the equivalent of $302,000 of federal debt hanging over their head:

Before the federal government had had much chance to intervene in economic affairs in the USA, the ratio of debt-to-income remained below 2.0. But with socialist policies — such as the policy of ObamaCare, and the many “public-private partnerships” which have been created — we’re now at levels that really harm growth:

In percentage terms, as a nation, we have a debt-to-income of 328%, which is appalling.

Let’s hope that the new Trump administration, along with the Department of Government Efficiency (DOGE), can provide a course correction — because double-digit debt growth is not sustainable when nominal incomes are expected to grow by less than 5% a year. Growing debt more than twice as fast as income is a very bad thing.

Reference

U.S. Department of the Treasury. Fiscal Service, Federal Debt: Total Public Debt [GFDEBTN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEBTN

U.S. Bureau of Economic Analysis, Personal income per capita [A792RC0A052NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A792RC0A052NBEA

U.S. Bureau of Labor Statistics, Population Level [CNP16OV], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CNP16OV

U.S. Bureau of Economic Analysis, Personal income [A065RC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A065RC1A027NBEA

Board of Governors of the Federal Reserve System (US), Nonfinancial Sectors; Debt Securities and Loans; Liability, Level [BOGZ1FL394104005Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FL394104005Q