The USA is at a tipping point and there is a chance that we may lose the freedom and prosperity associated with The American Dream. When attempting to save America, and therefore human freedom, some hurdles are in place. Attempted solutions are often limited by whether there is “political will” to enact the measures required.

The Fraser Institute defines 5 things required for continued peace and prosperity:

•Size of government.

•Sound money.

•Property rights and rule of law.

•International trade.

•Regulation.

Harm to any one of them may require over-compensation in the others in order to remain on the right track. Some solutions which put a nation on a sustainable track of success are not necessarily politically popular. What follows is a solution that is virtually guaranteed to work when viewed “on paper” — even if politically untenable.

Size of Government

A question about the right size of the federal government may run something like this:

When times are tough, what is the most spending expected of the federal government?

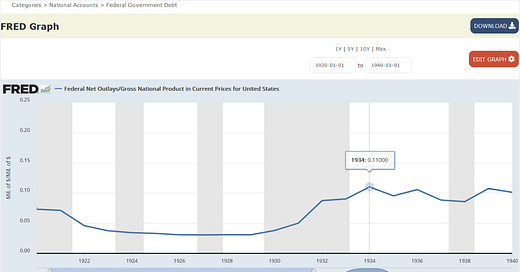

An answer to this question comes from the 21 years that span from 1920 to 1940, when times were approximately as tough as you could possibly imagine (the “toughest-of-times” involving The Great Depression):

When facing the greatest hardship imaginable — i.e., The Great Depression — the most federal spending that is to be expected is for the federal government to spend 11% of GDP. Because that also covers all of the easier times, a “hard cap” of federal spending down at 11% of GDP is prescribed by the historic, empirical data.

It is a level of federal spending which has proven itself to have been sufficient. When put in terms of the 2023 GDP, the “proper” federal budget — built for the hardest of times — would be capped at $3.05 trillion (11% of the 2023 GDP):

But if the federal budget had a “hard cap” of $3.05 trillion, and if the payment for the federal government was deliberately non-conducive of corruption, then one solution is a flat 13% “Fair Tax” (flat national sales tax; eliminating all other federal taxes) with a flat 15% tariff. Because both rates are flat, they eliminate corruption.

When rates are differentiated, so that one group gets a different rate than another, then there is the opportunity for corruption. Lobbyists will visit lawmakers with sweetheart deals, in order to bribe themselves into privileged positions. But such corruption becomes impossible when everyone is treated in the exact same way.

The U.S. Constitution prescribes the federal government to treat all in the same way.

A flat national sales tax of 13% treats everyone the exact same way. If you buy a product, then you pay 13% federal sales tax. If you don’t buy a product, then you do not pay any federal tax. By taxing only consumption, savings are incentivized — which opens up the possibility of future growth through investments.

International Trade

A flat tariff of 15% means that no nation is favored, just like no citizen would be under a flat national sales tax. Everyone, everywhere, pays exactly the same rate — undercutting any opportunities for corruption. The U.S. Constitution only allows for tariffs to be utilized for revenue, not for specific “protectionism” of domestic industry.

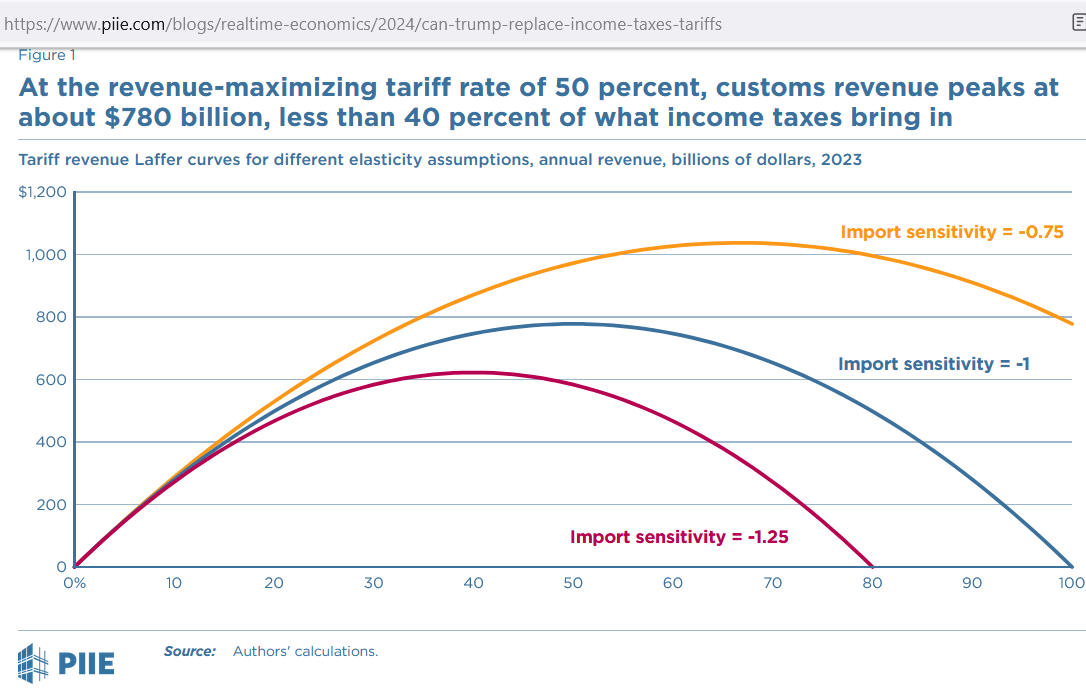

When the flat tariff is set to 15% for all nations exporting to the United States, then the revenue is $0.4 trillion ($400 billion):

The red curve indicates the conservative view regarding expected retaliation regarding tariffs, with government revenue peaking out at 40% tariffs, but with 15% tariffs being on the “safe side” (the free trade side) of what’s possible. Any tariff values above 40% can reduce government revenue, as other nations retaliate in a trade war.

Further empirical evidence that a 15% tariff is low enough to allow for economic growth comes from the history of the average rate of tariffs on dutiable imports, where tariffs did not begin to be lower than 15% until after WWII:

With $0.4 trillion covered by the tariffs, that leaves $2.65 trillion to be covered by the flat national sales tax (“fair tax”). The flat national sales tax comes with what is called a “prebate” — where the federal government sends you a check every month (or a credit on your consumption purchases).

This prebate is universal, in order to foil the opportunity for corruption.

While all consumption is taxed with a 13% flat national sales tax, because of the prebate that is set to the poverty level of consumption, you only really pay that 13% when consuming more than poverty level. Back in 2007, the sum total of poverty-level spending was $2.112 trillion, but here is the consumption for 2023:

When you begin with $22.5 trillion in consumption spending (spending which is taxable under the single-federal-tax plan), but then subtract the $2.112 trillion in prebates which pays for people to consume at poverty level, then you get a federal tax base of $20.4 trillion.

Because $2.65 trillion is required to cover the balance from the initial federal outlay of $3.05 trillion — after tariff revenue has reduced it by $0.4 trillion — the percentage rate on the flat national sales tax has to be 13% (0.13 * 20.4 trillion = 2.65 trillion). This pays for all of the federal government which was ever needed in The Great Depression.

Sound Money

Sound money is the easiest to implement, though it may be hard to find the political will to do it: All that you have to do is simply return to the Gold Standard.

Particular problem solved.

Property Rights/Rule of Law/Regulation

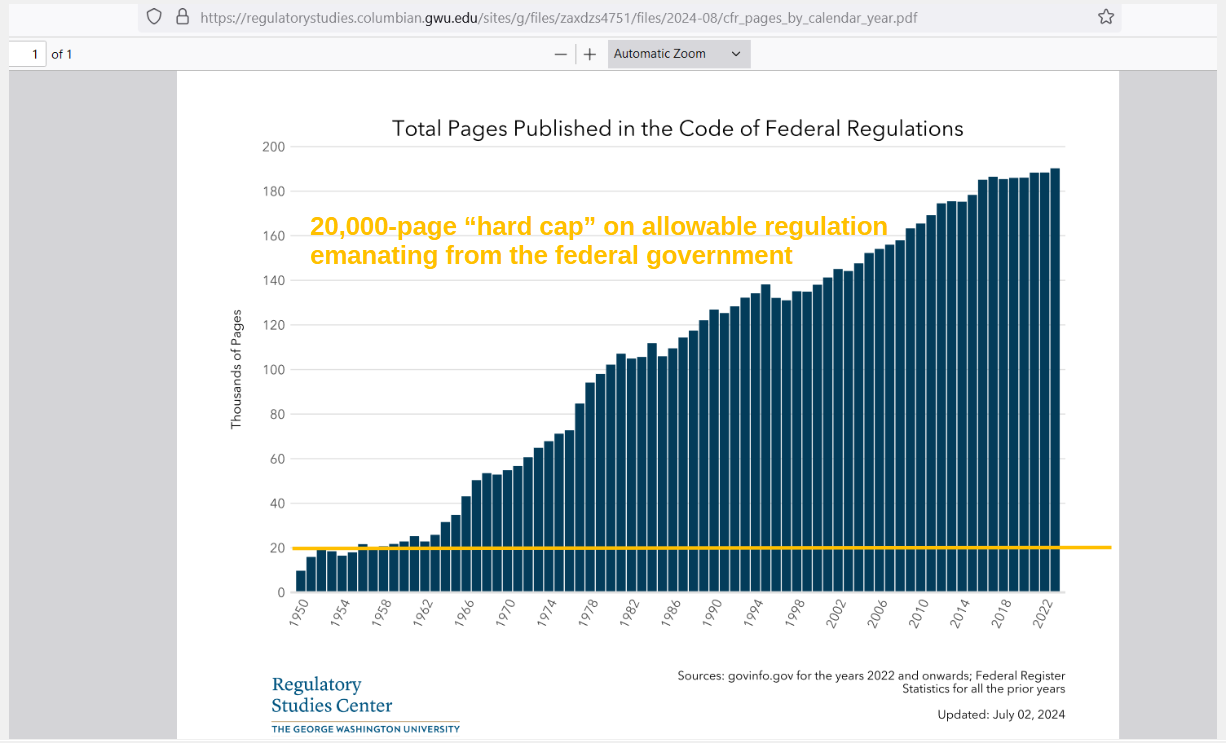

Property Rights and Rule of Law can be treated in the same broad stroke as Regulation: By limiting the total amount of federal law which is allowed. In the 1950s, the empirical experience of the USA reveals that the total amount of federal law needed in order to successfully run a country is below 20,000 total pages:

[orange marks added]

In order to create new regulation, the federal government would then be required to remove prior regulation, so that the “hard-cap” of total federal law did not exceed 20,000 total pages. The experience of the 1950s proves that it is possible to have federal law contained within 20,000 total pages, and anything more invites corruption.

The evidence suggests that America can be saved, but that the primary hurdle will involve developing the political will to enact the solution. Relying on the proverb that “the perfect is the enemy of the good” — the above plan is just imperfect enough to virtually guarantee national success and restoration, if it is ever implemented.

The options and numeric values outlined above** are not merely theoretical, they are options or values which have a track record of success, empirically. Living standards improved during all of the options and numerical values outlined above. As such, they have been empirically-validated as options and numeric values which “work well.”

**the Flat National Sales Tax (FNST) — or “fair tax” — is the only thing never tried in the USA, but the tax rate on it has been tried, and with success. Because it abolishes the IRS, along with all other non-tariff tax, it is predicted to have lower maintenance costs, along with incentivized saving (predicted to be better than anything ever tried).

Reference

[early federal spending] — U.S. Office of Management and Budget, Federal Net Outlays [FYONET], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FYONET

[early GNP] — National Bureau of Economic Research, Gross National Product in Current Prices for United States [A08165USA144NNBR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A08165USA144NNBR

[2023 GDP] — U.S. Bureau of Economic Analysis, Gross Domestic Product [GDPA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPA

[tariff revenue corrected for retaliation] — https://www.piie.com/blogs/realtime-economics/2024/can-trump-replace-income-taxes-tariffs

[history of average tariff rates] — https://www.cato.org/publications/problem-tariff-american-economic-history-1787-1934#protectionism-income-tax-era

[poverty-level consumption of 2007] — TAXING SALES UNDER THE FAIR TAX: WHAT RATE WORKS? https://www.nber.org/system/files/working_papers/w12732/w12732.pdf

[consumption of persons] — U.S. Bureau of Economic Analysis, Personal Consumption Expenditures: Total for United States [USPCE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USPCE

[consumption of states] — U.S. Bureau of Economic Analysis, State and Local Government Consumption Expenditures and Gross Investment [SLCEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SLCEA

[consumption of states (2)] — U.S. Bureau of Economic Analysis, State and Local Government Gross Investment [SLINV], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SLINV

[consumption of federal government] — U.S. Bureau of Economic Analysis, Federal government consumption expenditures [A957RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A957RC1Q027SBEA

[pages in the Code of Federal Regulations] — https://regulatorystudies.columbian.gwu.edu/sites/g/files/zaxdzs4751/files/2024-08/cfr_pages_by_calendar_year.pdf

Even though I think taxes are evil, I have always believed that a consumption tax is the "fairest". It's the only tax that allows a person to "opt out" (unless our food is taxed). The current tax system is used to wheel and deal. We see it every election season "I'm going to end taxes on tips!" "I'm going to end income tax for fireman and police!" (etc, etc, etc). I don't remember a time in my life when one of these "promises" has ever come to fruition. Instead I always hear how "we can't afford a tax cut!". These politicians don't give a crap that this money does *not* belong to the government. All of these so-called "tax cuts" are easily affordable by shrinking the size of this monster that is completely out of control. My hope is they will be forced to end the empire and will have no choice but to make some changes. Meanwhile they empower the IRS with more money and thousands more agents to go after people like me who owe 100$ while the debt increases by a trillion dollars every 90 days (or whatever it is now). How is going after people who "owe" pennies ever going to even make a dent in this debt? It won't. It's a huge control scheme. And I'm sick of it.

Most folks don't know we didn't have an income tax before 1913. It started at 1% with a surtax of 6% for high earners. Rates rapidly increased thereafter.