Private Credit Danger Zone

Post #865

Private credit drawn out from credit cards is “supposed to” be less than the sum total of all personal savings. If credit card balances exceed personal savings then the indication is that people are so dirt broke that they are taken to using credit cards for staple items — such as for purchasing food — where you have to borrow just to eat.

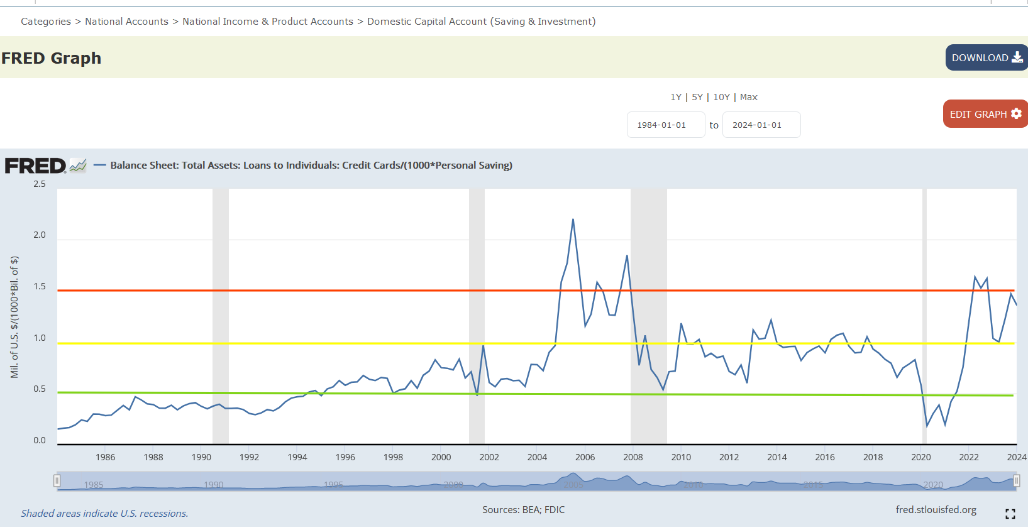

In the healthy economy of the 1980s under Ronald Reagan, people held credit card balances that were below the sum total of all private savings. But in 2023, for the first time ever, the sum of all credit card debt exceeded $1 trillion. It wouldn’t be doom-and-gloom if personal savings had risen, but personal savings is not going up:

The ratio of credit card balances to personal saving was under 0.5 in the early 1980s, but it rose up into the red zone (danger zone: credit card balances exceed savings by 50%) prior to the government-caused housing and financial crisis of 2008. It recently broke through into the red zone again, and is still in a danger zone.

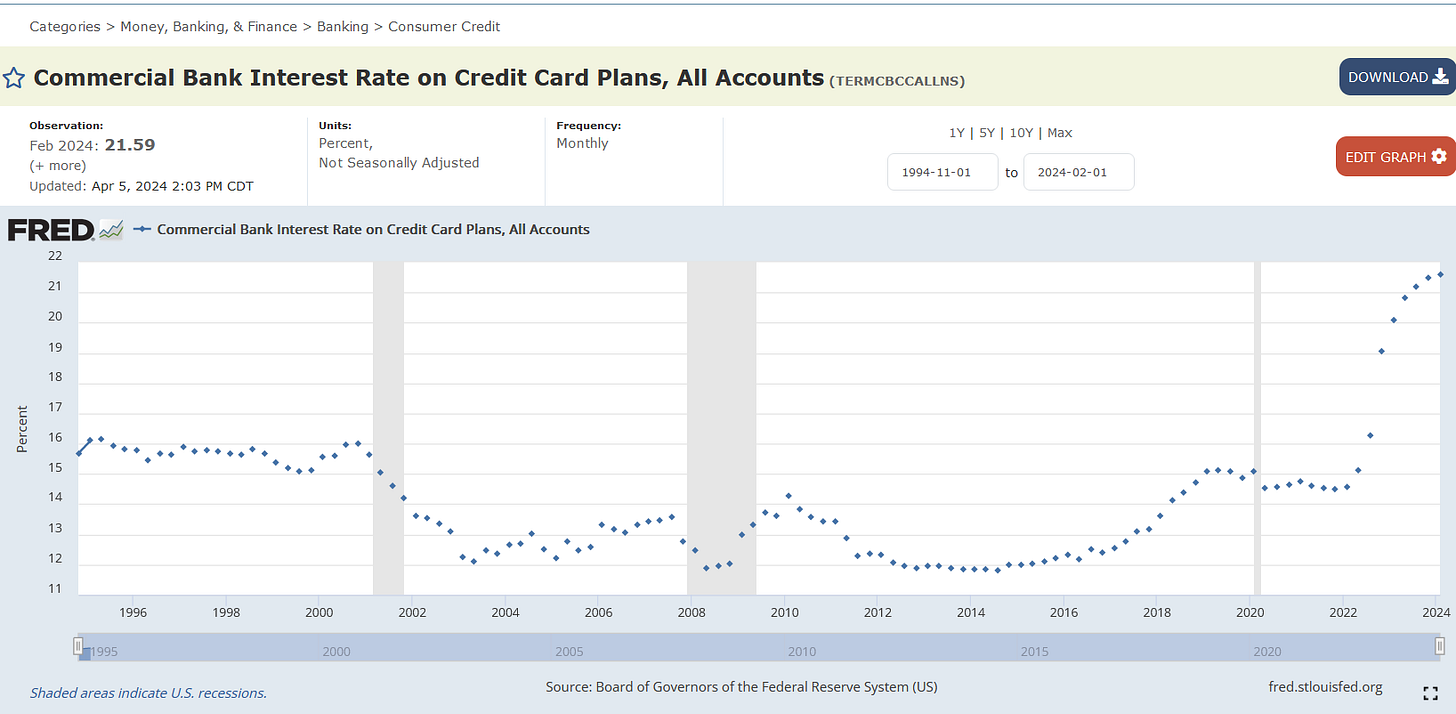

Critics and detractors may try to say that it is okay for rising credit card debt levels, because personal income rose to match the rise. But this argument breaks down when you examine the interest rate that the higher debt load is being carried at:

At 21% interest on a much higher debt load, households are getting pummeled. To get back to being the land of opportunity and a nation of prosperity requires a slash-n-burn “shock therapy” technique where entire departments of the government are shut down, perhaps with a 1 year grace period to let government employees find new work.

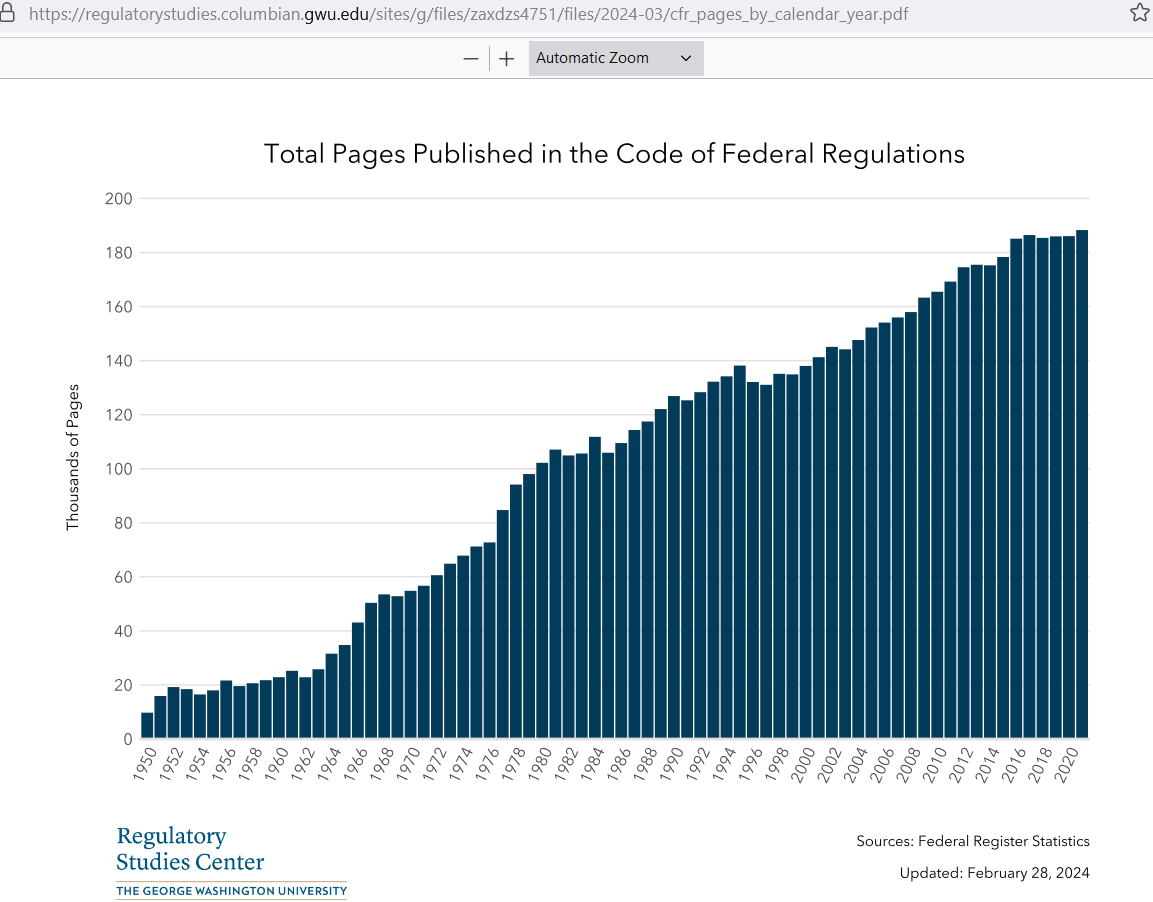

Over half of the 180,000 pages of the Code of Federal Regulations (the body of federal law), could be burned overnight (with little or no warning to affected parties) and very little harm would be expected to come to innocent people from this abrupt loss of regulations:

We made great progress for more than a century without any of these pages of federal regulations, showing that we didn’t need them in the first place — things that you can go without for an entire century without demonstrable harm are, by definition, things that you did not need in the first place.

The worst thing that we can do is to increase the regulation and the centralization of resource allocation — i.e., invoke a Great Reset where government technocrats tell people how much they are allowed to own, how much or whether they can eat meat, whether they can use fuel, whether they can travel, etc.

Reference

Regulatory Studies Center. Trachtenberg School of Public Policy and Public Administration. Columbian College of Arts & Sciences. George Washington University. https://regulatorystudies.columbian.gwu.edu/reg-stats