Four things are thought by economists to bring prosperity:

Sound money

Low government spending

Low government regulation

“Free and fair” trade

Because the USA is in dire straits financially, flirting with economic ruin [a recent essay by A Midwestern Doctor], that means that having a game plan can help. A good game plan, one which should save the USA from disaster, would be to restore the economic freedom that we had back in 1950.

Sound Money

The purpose of sound money is so that price signals convey good information. An example could be the simple decision of whether to make a purchase this week, knowing that you don’t get paid until next week.

To avoid running out of money before your next paycheck, it is absolutely essential that the price of things does not rise uncontrollably over the next 7 days. If it does, then you run out of cash, and must go without eating.

Venture capitalists investing in the future output of a start-up enterprise also need for it to be the case that the price of things does not change wildly before the enterprise comes to fruition and brings products online.

Besides the interference with price signals, there is wage power (the purchasing power of wages). Historically, price increases outpace wage increases, and the buying power of wages goes down when inflation runs high.

The lost price signal mentioned above is an inefficiency which explains why real wages drop under high inflation rates. When real wages drop, then the allocation of resources becomes more centralized (fewer people make more of the decisions) — creating an additional economic inefficiency which harms wealth creation.

Immediately-spendable cash (circulating currency) has the strongest effect on price inflation. Here is a graph of the yearly percent change in circulating cash (currency) minus the yearly percent change in wages earned in the private sector:

Because wages during the 1950’s rose just as fast or faster than circulating currency did, the wage earners of the 1950’s did not lose any purchasing power (no inflation was “felt” by them).

The only year that circulating currency grew at least 1% faster than wages was 1958.

Notice the general trend of things: currency growth becomes faster than wage growth. And look at the terrible thing that government did in 2009: currency growth was 15% more than wage growth — making all wage-earners more poor.

As more money is printed, the purchasing power of elites rises in relation to the purchasing power of the masses. Restoring to the sound money of 1950 would help the USA tremendously. It is not just efficient, but moral as well. Robbing wage earners of their purchasing power is immoral.

Low Government Spending

When the government allocates a greater share of resources, inefficiencies arise, harming wealth creation.

The share of GDP spent by the federal government should remain very low because, in the US Constitution, there are only 18 tasks laid out for the federal government to perform (Article I, Section 8) — and it doesn’t require much federal spending in order to accomplish them all.

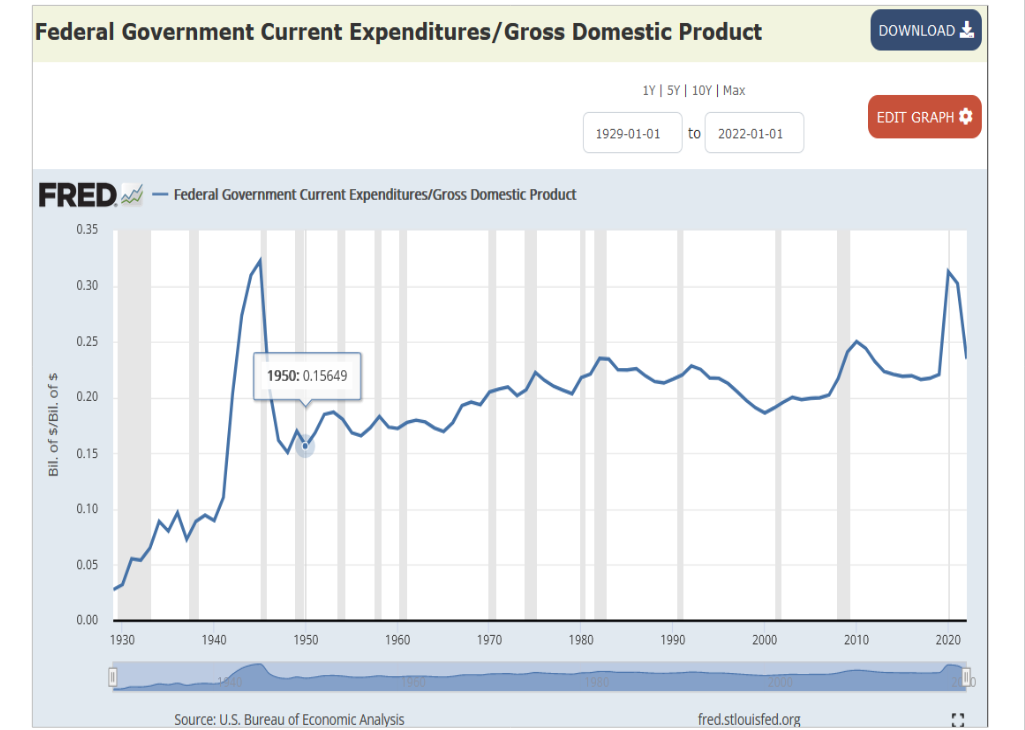

Back in 1950, the federal government spent less than 16% of GDP:

The federal spending prior to 1930 reveals how much it costs for the federal government to accomplish those 18 tasks outlined in the US Constitution (less than 5% of GDP).

By capping federal spending at 16% of GDP, the hyper-centralization of resource allocation can be prevented. When federal spending rises above 5% of GDP, it is evidence that the federal government has broken the restraints of the US Constitution.

While the better cap on federal spending is 5% of GDP, a 16% cap represents a step in the right direction and, along with the other measures here, would open up such new wealth creation that the USA could pull itself out of financial ruin.

Low Government Regulation

When the US Constitution was written, there were only 3 federal laws in it:

no treason is allowed

no counterfeiting of money

no piracy on the High Seas

But the body of federal laws, the Code of Federal Regulations, has grown immensely, so that “red-tape” is so high now that it is no longer easy to create wealth inside of the United States.

Back in 1950, there were less than 10,000 pages of federal law:

Putting a “10,000-page” cap on the amount of acceptable federal law would open up the United States for high levels of wealth creation — like we had in 1950.

“Free and fair” Trade

Perhaps the hardest measure to guage is trade policy, because trade barriers come in a variety of forms. A tax on imports is a tariff, but there are also non-tariff trade barriers. While it is by no means the best measure or indicator of free and fair trade, the export share of GDP is a rough-and-ready, or a quick-and-dirty, measure:

The historic trend suggests that a healthy level of trade is to export products worth 6% of GDP, but this is the one case when 1950 doesn’t meet the bar (1950 export share was about 4% of GDP).

One explanation for that low share of GDP being exported in 1950 is that other nations were much more poor (they couldn’t afford to “buy” our exports). This means that we bought more products “from ourselves” (domestic production) because we were the only ones on Earth able to afford them.

Returning to the economic freedom markers of 1950 is predicted to save the USA from economic ruin. Failing to restore economic freedom is no longer an option.

Sadly there is a Marxist/WEF takeover to bring on the great reset. They want North America ruined.

Everyone wants free stuff from the government.

Hoax after hoax is being played on the people as well as censorship. They have an agenda and are even manipulating elections. I don’t know if common sense will win out in the end.