In finance, disposable income is what you have left over after paying taxes and government fees. Discretionary income is what you have left over after paying for necessities on top of paying for the taxes and government fees. Discretionary income is entirely at your disposable because there are no claims on it.

But in an economy where the government can borrow tons of money, there is a future claim that accrues on the citizens. Even if government tries to inflate its way out of some of the debt, that inflation destroys the purchasing power of your dollars — just as if someone had reached into your pocket and pulled some of the money out.

The truly-discretionary dollars are dollars that are at your full disposal (truly disposable)

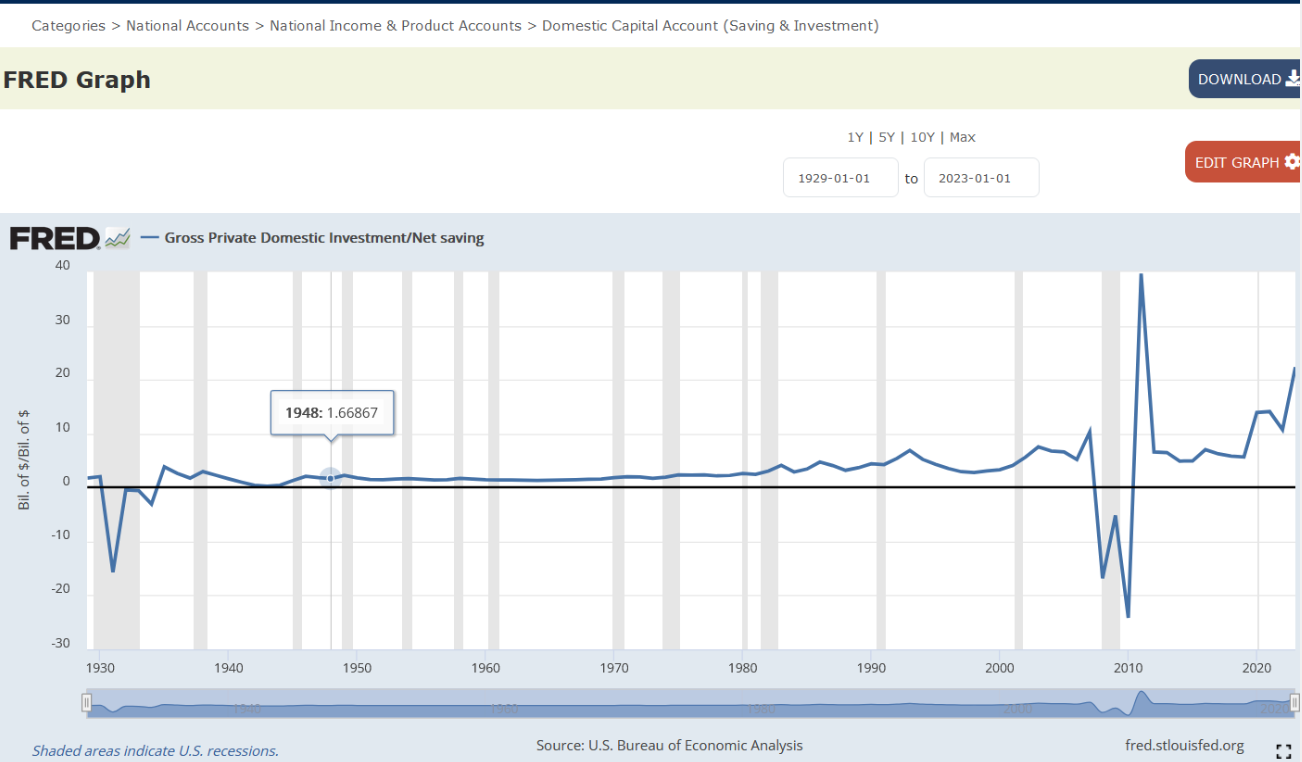

Because economies require annual investments, members of the private sector will steer some of their dollars toward new investments each year. Keeping in mind that the government can run deficits that ultimately destroy saved dollars, it would be interesting to compare the dollars invested to the truly discretionary dollars owned:

1948

In 1948, for every $1.00 that was truly at the disposal of someone (a dollar with no claims on it), there was $1.67 invested into growing the economy.

1969

By 1969, the situation had not changed much, and for every $1.00 truly at someone’s disposal, $1.60 was invested into economic growth.

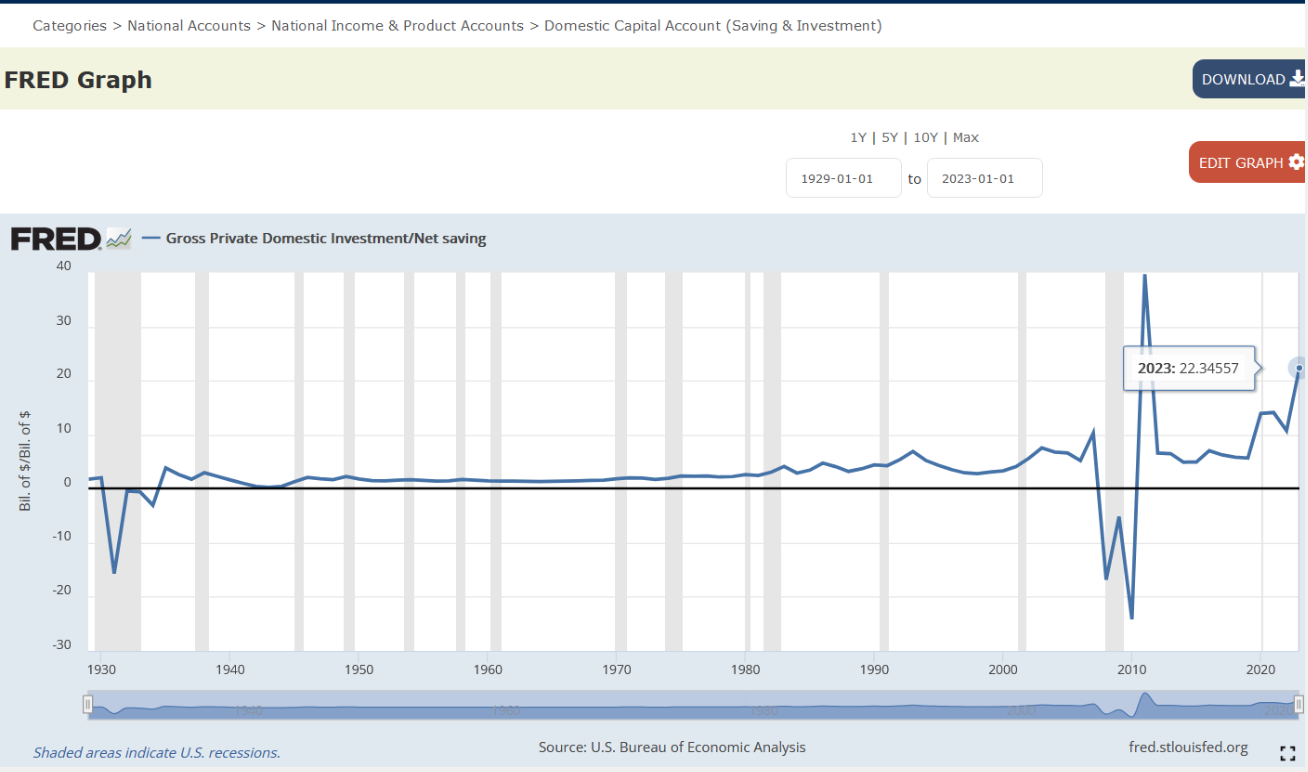

2023

In 2023, for every $1.00 that was truly at someone’s disposal, there was $22.35 invested.

Wait …

… what?

The evidence suggests that we can no longer afford to invest into the U.S. economy, because there are not enough dollars that are truly at the disposal of the parties who might do the investing. To turn things around, capitalism must be restored. This means a big haircut for the U.S. government (vastly reduced size and scope).

Business-as-usual has us on a trajectory of national bankruptcy within a few years.

Reference

U.S. Bureau of Economic Analysis, Net saving [W201RC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/W201RC1A027NBEA

U.S. Bureau of Economic Analysis, Gross Private Domestic Investment [GPDIA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GPDIA

... and since these monsters weren't willing to give themselves that haircut, it may be forced on them. And we will all suffer the consequences for their malfeasance.