Globalist elites are those shadowy power-brokers behind the Great Reset. They’d like to freeze the current social castes so that they can remain on top for the rest of their lives. To guarantee this, they plan to do away with the economic freedom in the world.

Loss Aversion

The field of behavorial economics has identified something called loss aversion, where people who’ve gained something are really very interested in never, ever losing it. Savvy salespersons may hand you items in the store in order to invoke loss inversion in you. If successful, when they go to ask for the item back, then you’ll say:

No thanks. I think I’m going to keep this item for myself. How much does it cost?

The value you ascribe to gaining something is not the same magnitude of disvalue you would ascribe to losing it. Winning a $100 bill at the casino may provide you with, say, +20 utils (term for a unit of utility), but in the unfortunate circumstance of losing it, you would ascribe -45 utils or so — over twice as much — to the disvalue.

This means that, once someone gains a lot, or reaches the top, they’ll fight like banshees to remain there. Losing what they gained is more than twice as important to them than what it was to gain it in the first place.

If they got to the top via the free market, they might seek to undermine the free market once reaching the top — when the forces of loss aversion alter their personal hierarchy of values by so much.

The First Glimpse of the Great Reset

You can trace the “beginning” of the Great Reset back to Lyndon B. Johnson’s Great Society plan which sought to grow the powers and the reach of the US federal government: to supposedly win a “war” against poverty, or some such blather.

As is so often the case it is now a joke, the bloated and expensive “socialization” scheme of LBJ did the reverse of what was advertised. Instead of the centralized money and power going toward help for “the little guy” — it was diverted to cronies, as is always the case when huge, centrally-planned enterprises are embarked upon.

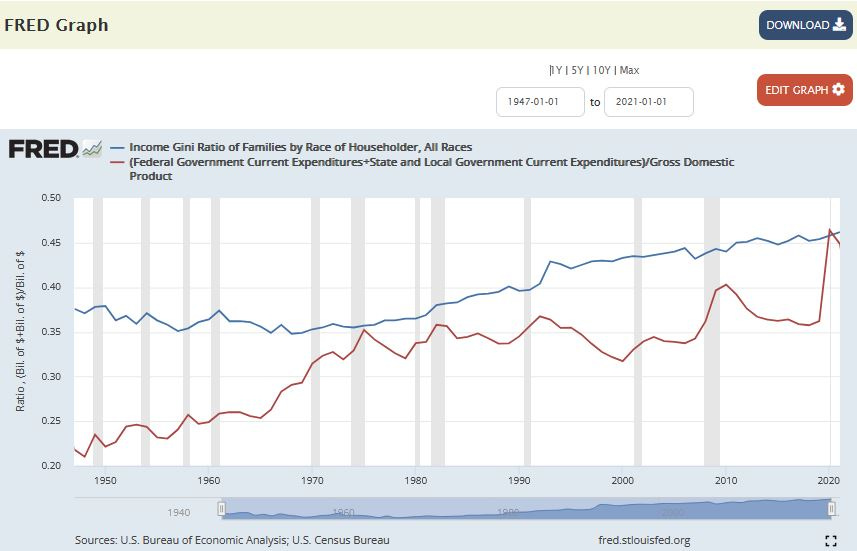

Have a look at two trends in the US, the blue line is income inequality, the red line is all-levels (federal, state, local) government spending as a fraction of GDP:

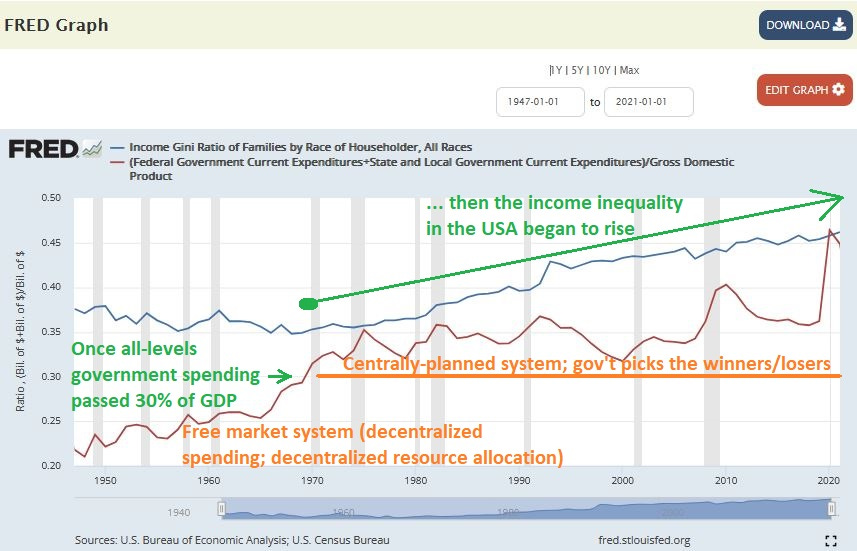

If you look “mid-decade” between 1960 and 1970, you can tell the break-point where socialism (LBJ’s Great Society) replaced capitalism as the dominant guiding force in the US federal government.

Here is the same graph with notes:

Evidence on perpetually rising income inequality suggests that the proto-Great Reset occurred in the 1960s, when LBJ vastly expanded the functions of the US federal government.

World Economic Forum elites want even more central planning and central spending, ostensibly to save the earth, or some such blather. But they fully intend to solidy their position at the helm of the world, and we can expect evermore income inequality as they revive a caste system on planet Earth.

The antidote to this world takeover is to vigilantly insist on personal and economic freedom from authoritarian power-mongers. An education campaign which reveals how economic controls empower cronies is in order.

We can’t reverse the loss aversion that elites become stricken with, but we can demand economic freedom from lawmakers (hobbling those elites who seek to do us harm). People need to learn where the wealth required for maintaining a living standard comes from.

It comes from freedom.

Reference

[inequality index] — U.S. Census Bureau, Income Gini Ratio of Families by Race of Householder, All Races [GINIALLRF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GINIALLRF

[federal spending] — U.S. Bureau of Economic Analysis, Federal Government Current Expenditures [AFEXPND], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/AFEXPND

[state/local government spending] — U.S. Bureau of Economic Analysis, State and Local Government Current Expenditures [ASLEXPND], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ASLEXPND

[economic ouput] — U.S. Bureau of Economic Analysis, Gross Domestic Product [GDPA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPA

[Basic introduction of loss aversion showing how loss aversion can turn rich magnates into criminals] — Loss aversion. https://www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/loss-aversion/

Well written! Thank you