The Vigilant Fox recently reported on how Mark Cuban thinks Trump policies caused inflation, but then Bill O’Reilly “fact-checked” Cuban with some data about energy policies from Biden, policies suspected of contributing to inflation. But the issue boils down to the quantity of money in civilian hands, and the propensity to buy things:

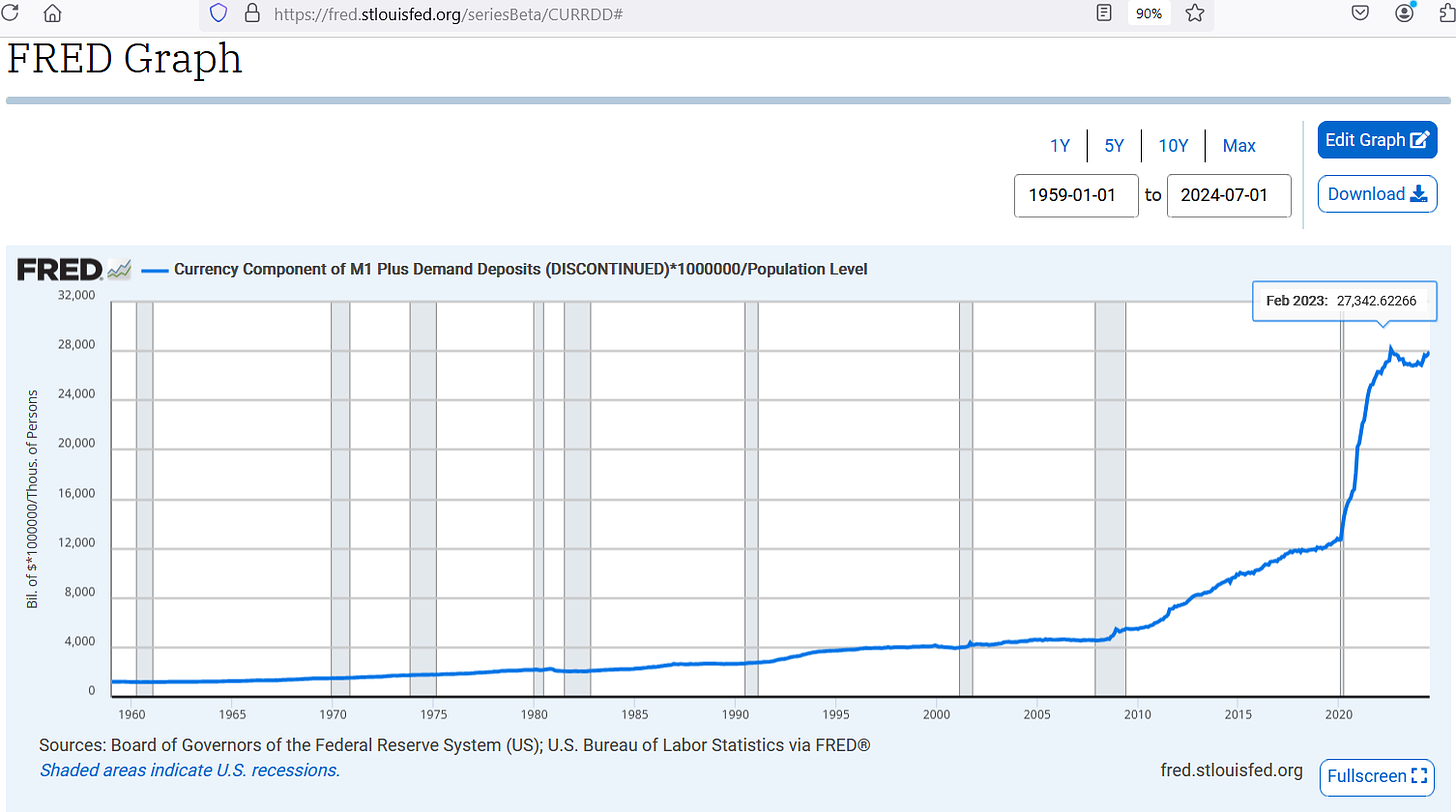

The graph above uses “immediately-spendable” money, the balance of checking accounts along with the stock of held cash. In Feb 2020, for every person over the age of 15, there was $12,700 in immediately-spendable cash. But by Feb 2023, there was $27,300 in cash per person. That’s more than twice the spendable cash, in just 3 years.

But to affect inflation, it has to be cash in civilian hands (the cash holdings of organized crime lords and of foreigners is not spent with as much velocity). Crime lords like to hoard cash in their personal vaults, and foreign holdings of US cash can slow down the velocity of money. Regular people also hoard cash in emergencies.

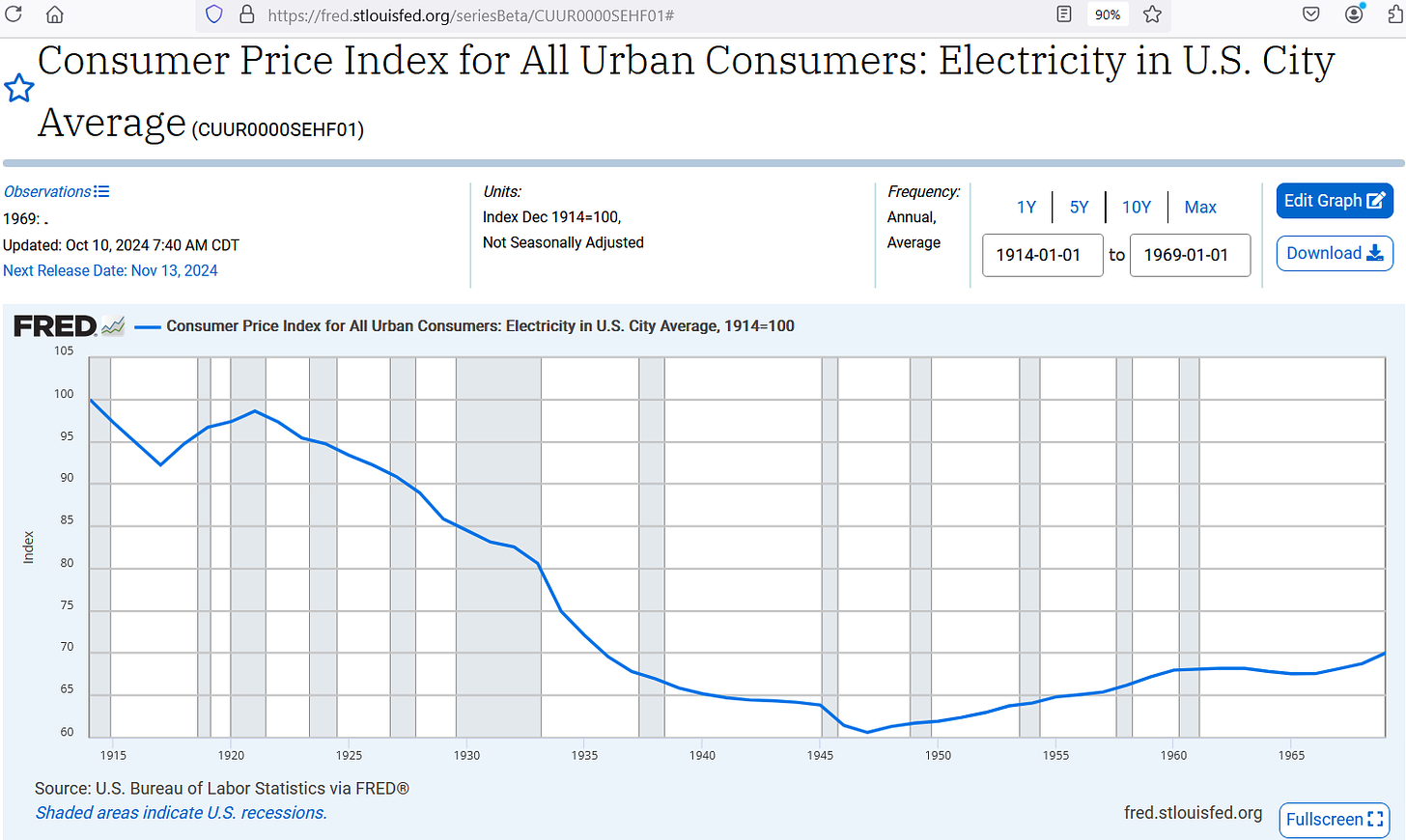

But even though both men missed the point (Milton Friedman’s point about too much money chasing too few things), Bill O’Reilly is still more correct than Mark Cuban. Back when the USA was a capitalist nation, electricity prices in 1969 were 30% below what they had been 55 years prior, in 1914:

The reason the prices fell is because competition creates falling prices. It is an aspect of unregulated capitalism that nearly everything becomes cheaper for ordinary consumers (the consumers grow relatively rich when there is capitalism). But after the 1960s, the USA drifted away from capitalism, created an EPA, and made prices rise:

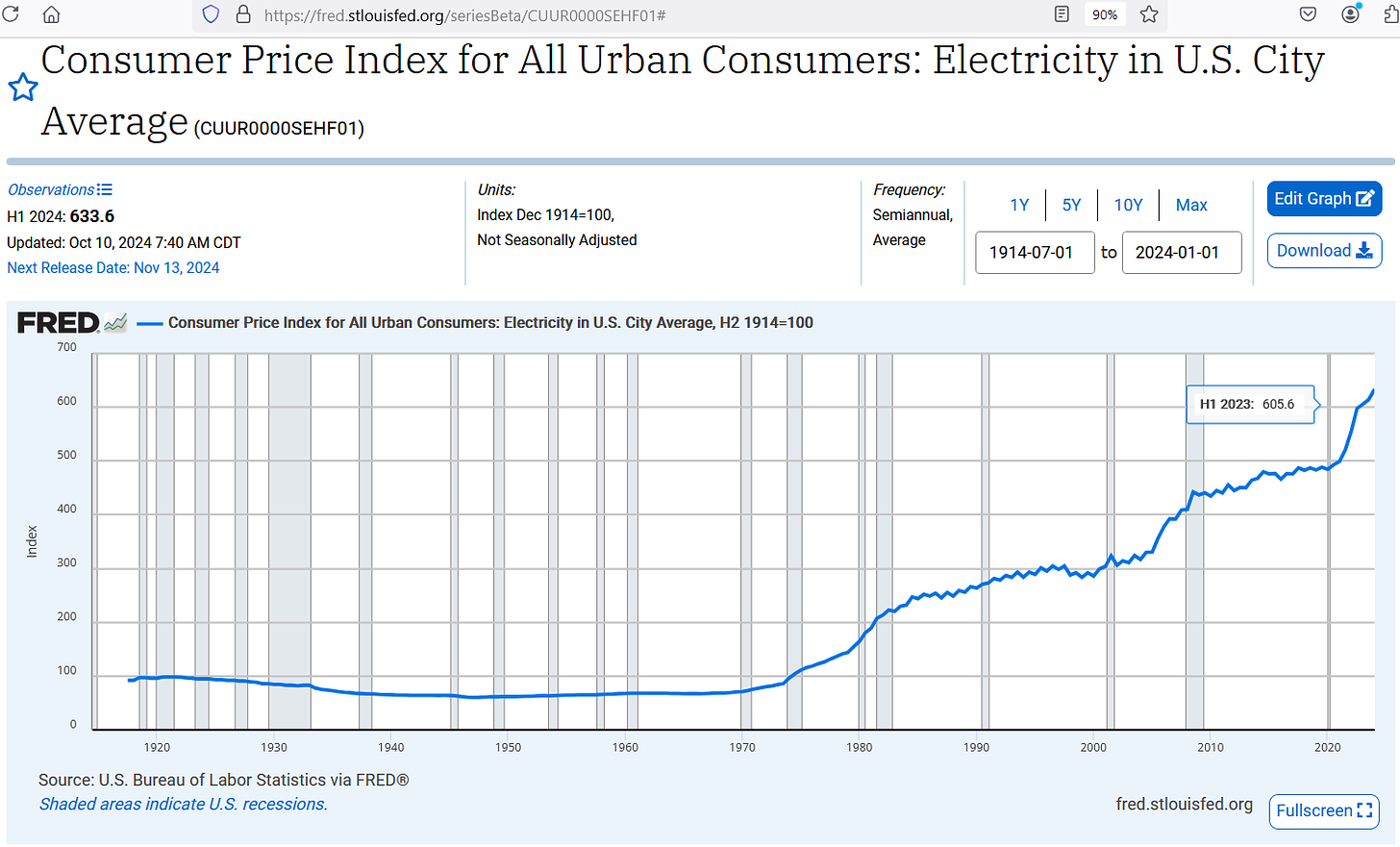

By the first half of 2023, electricity prices were 6 times higher than the prices of 1914 — after going through the steepest-ever trajectory that they had ever gone through. Evidence suggests that O’Reilly has a point and that we should not regulate energy production (or should regulate it less). But we should also return to sound money.

Reference

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Electricity in U.S. City Average [CUUR0000SEHF01], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUUR0000SEHF01

Board of Governors of the Federal Reserve System (US), Currency Component of M1 Plus Demand Deposits (DISCONTINUED) [CURRDD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CURRDD

U.S. Bureau of Labor Statistics, Population Level [CNP16OV], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CNP16OV