Avoiding what happened to Japan

Post #1472

What started out as a “Lost Decade” in Japan, actually turned out to be an entire “Lost Generation” — 30 consecutive years of economic stagnation:

Officials in Japan thought that they could fix things by lowering interest rates, or printing money, per se. But Austrian economist, Ludwig von Mises had earlier revealed the folly in such behavior (“phantom of cheap credit”):

When operating under “the hallucination of the illusory prosperity created by easy money” then malinvestments are made and you put your economy into stagnation. And, importantly, “the return to monetary stability does not generate a crisis” like the critics and detractors think. It was easy money that was papering-over prior mistakes.

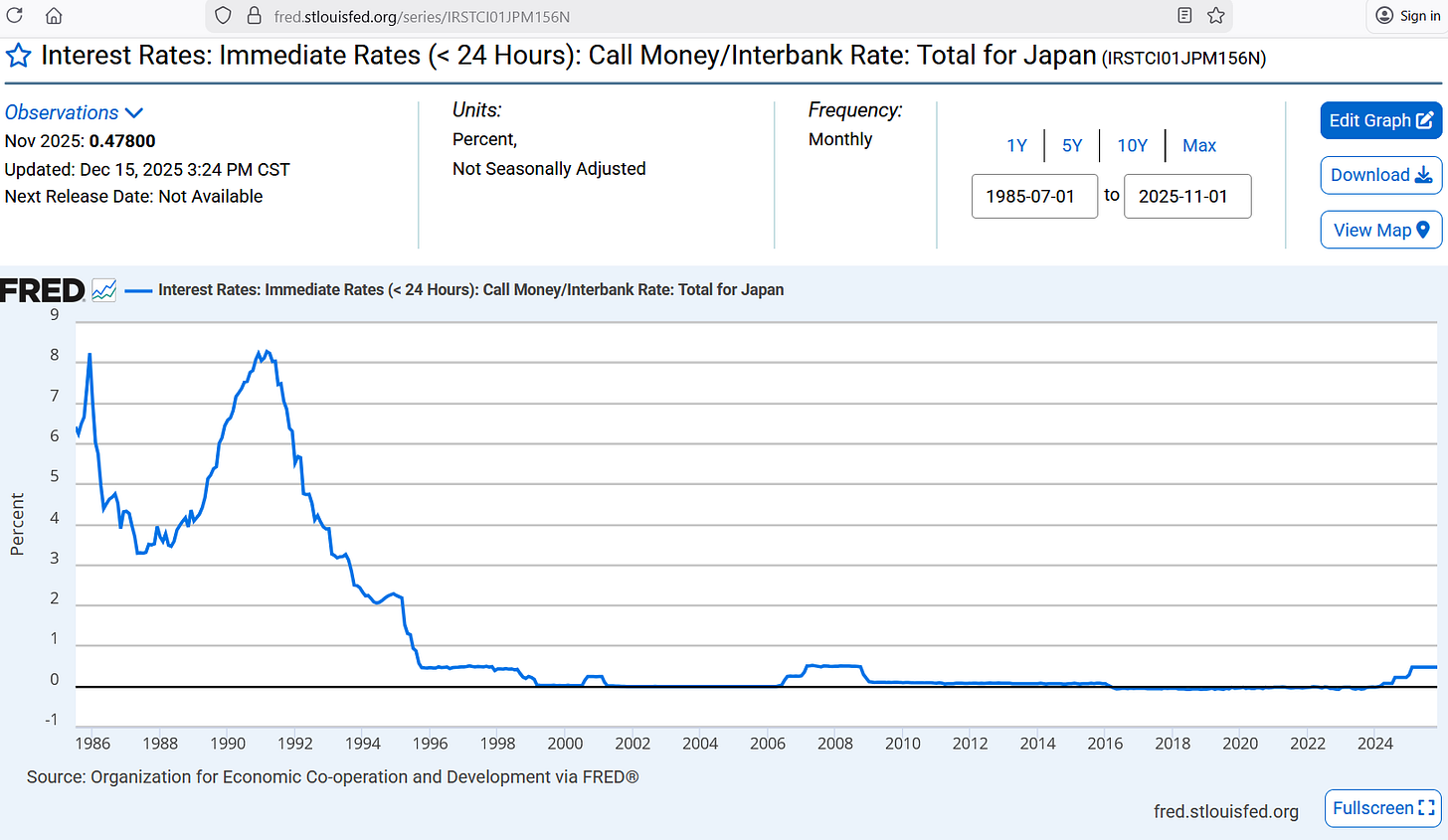

Believing that they would be able to “paper-over” the mistakes which were being made in their economy — rather than allowing markets to work — Japanese officials, besides issuing subsidies to firms, also cut the very-short-term (similar to our Federal Funds Rate) interest rates from 8% down to below 1% within 5 years!:

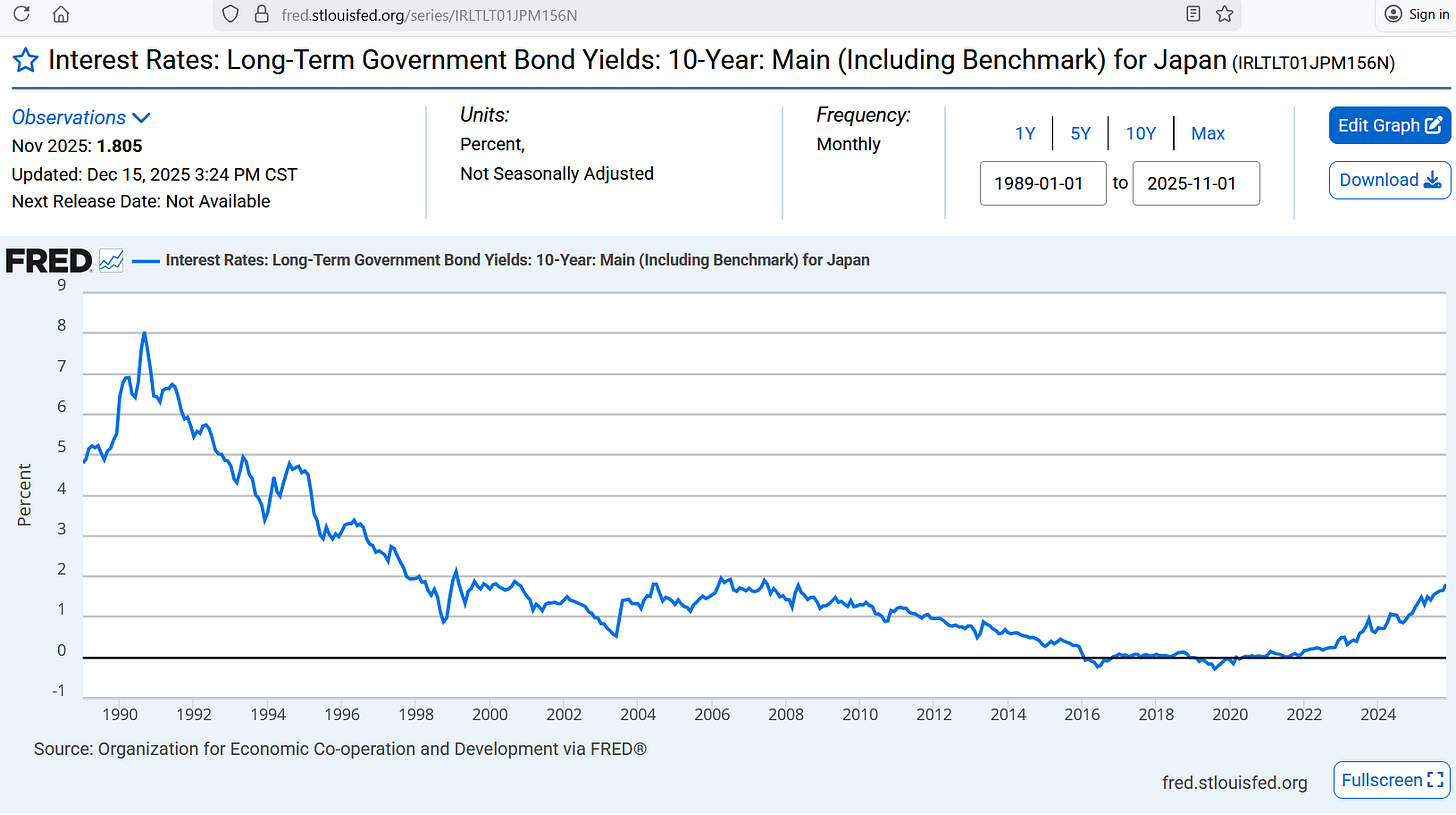

Mises and his peers would have been immediately taking bets on how bad it was going to get because Japanese officials thought they could paper-over a deficiency of economic fundamentals with corporate subsidies and cheap credit. Even the long-term rates bottomed-out, though not as abruptly:

Long-term rates indicate investor optimism. When they stay high, that is because the investor demand for saved currency remains high enough to keep the interest rate on the borrowed money high. With investor pessimism, like in Japan in the 1990s, the long-term interest rate falls, because people do not want to borrow to invest, anymore.

To kill productive ambition, you can “paper-over” any defect, leaving the defect there.

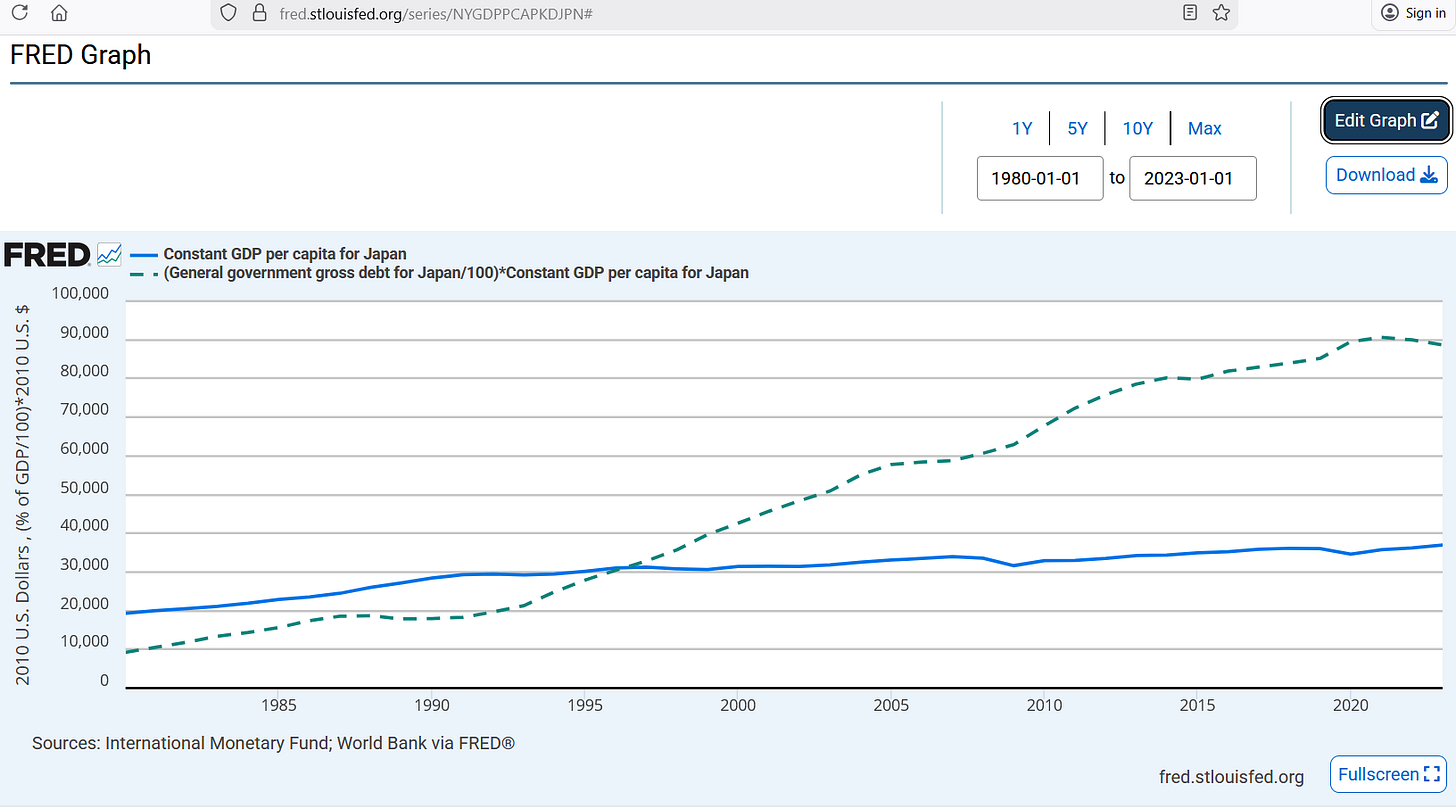

By 1997, the per capita share of government debt surpassed the per capita GDP, helping to cause the growth in real GDP per capita to stall out (at just over $30,000 per capita in 2010$). From 1991-2000, real GDP per capita barely budged. And at the low-point of 2009, it was right back where it had been in 2000:

While Japan went through this “Keynesian fiasco” before the USA, it appears that we did not learn Japan’s lesson:

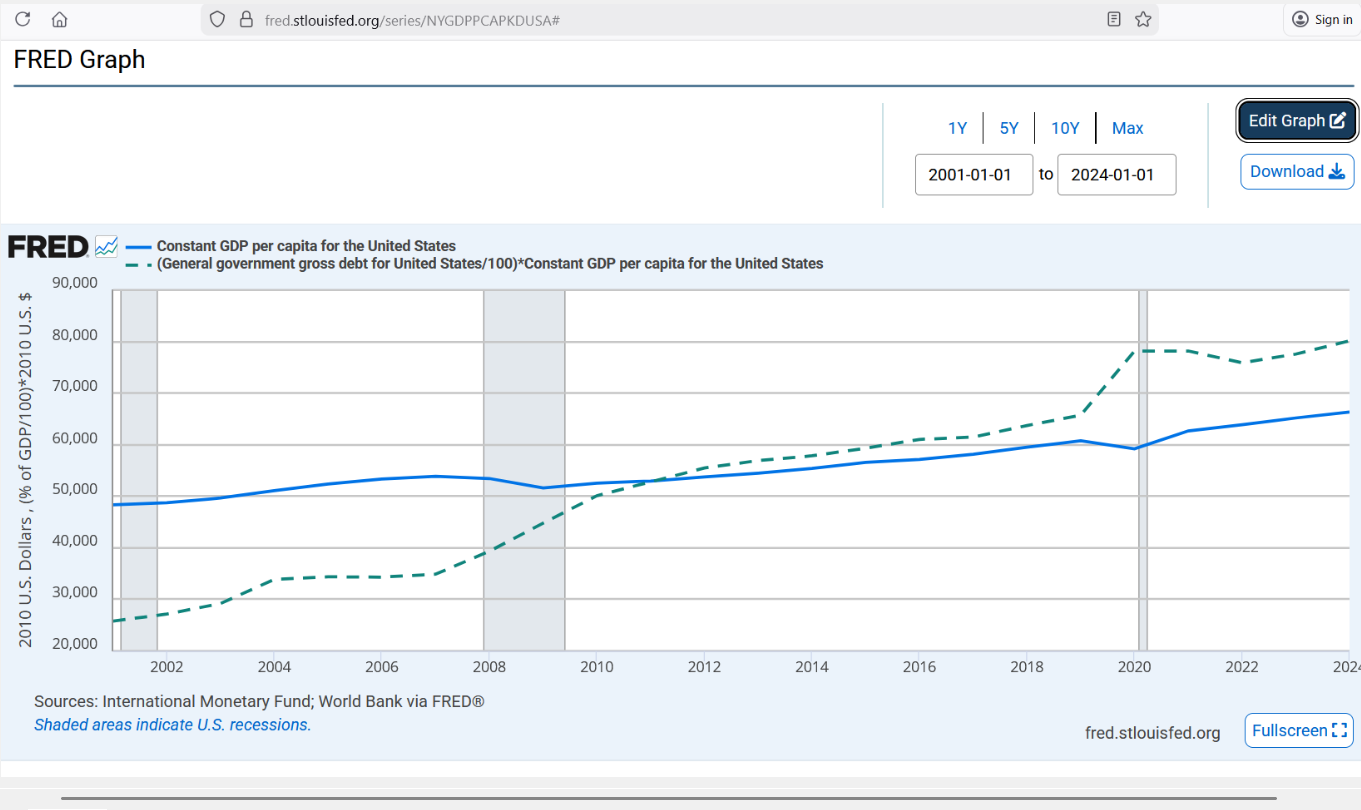

Fourteen years after the Japanese officials had caused their national debt to exceed their GDP, the USA followed suit in 2011 — though it was not until 2020 when we began to “look like” Japan in terms of runaway debt (completely untethered to GDP). But “papering-over” enriches the financiers at the expense of the middle class:

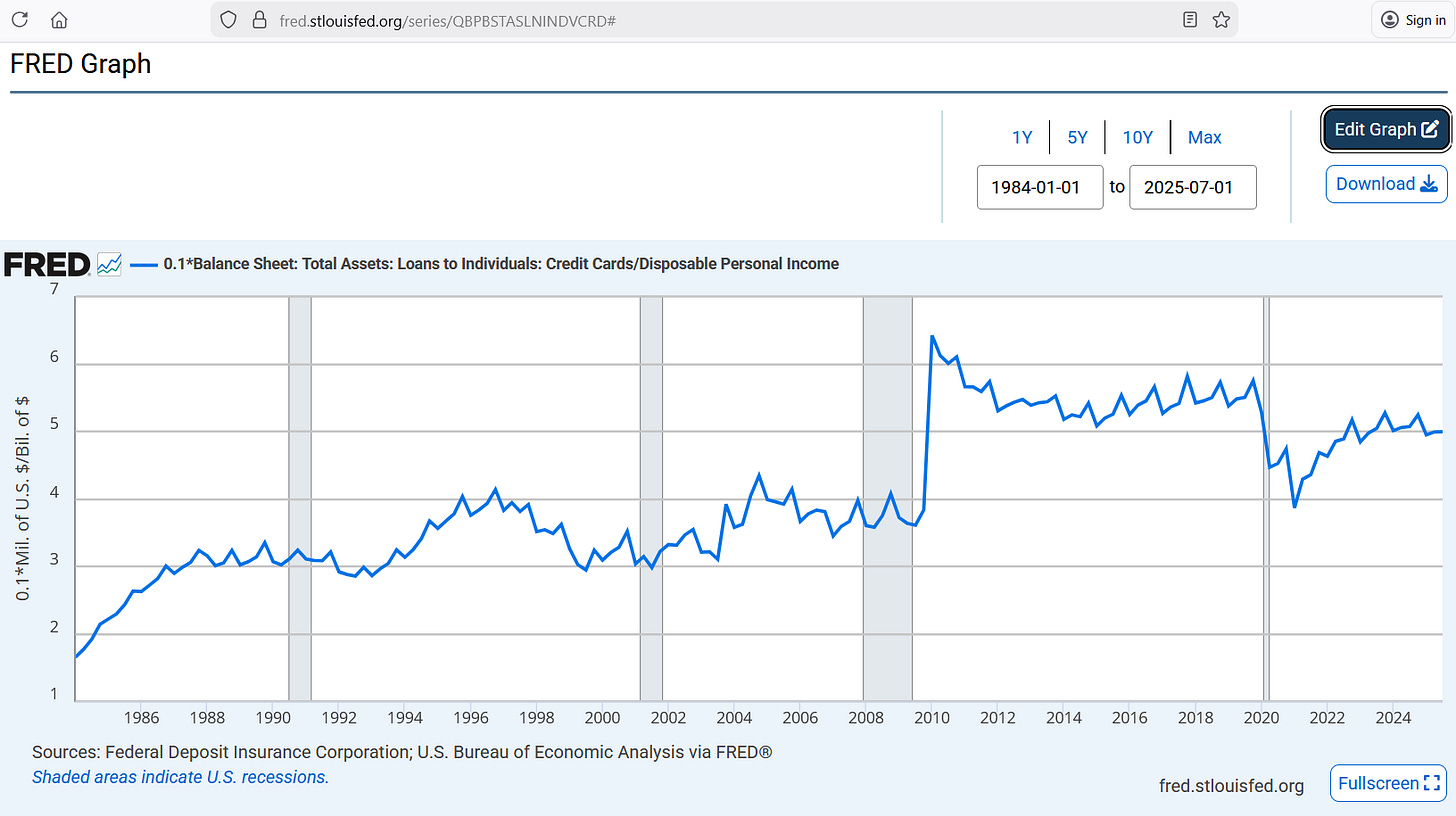

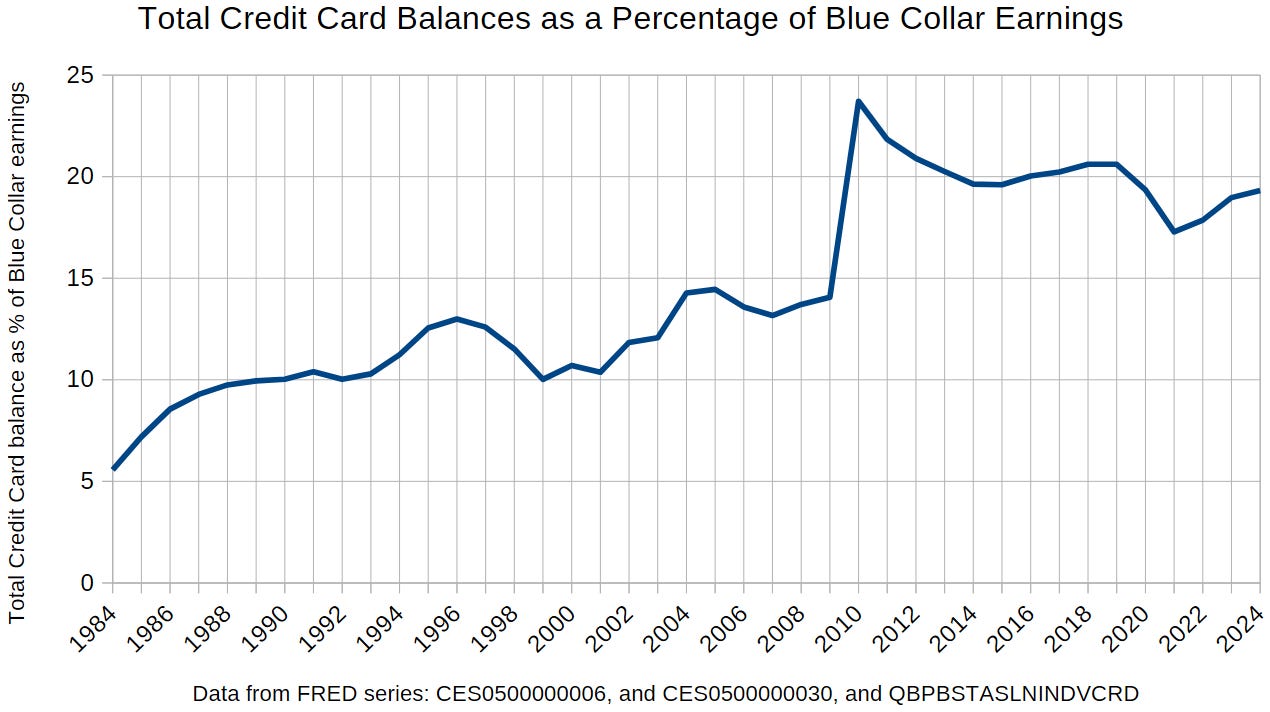

This chart shows the share of disposable income that matches the aggregate balances on credit cards, where credit card balances of 3% of disposable income are “good” but the recent 5% of personal income indicates people having to rely on credit cards for usual purchases. Put as a share of blue collar wages, the picture gets predictably worse:

When everyone’s credit card balance is matched to the combined earnings of only those workers in blue collar jobs (Production and Non-supervisory Employees), then a “good” amount of total credit card debt is akin to 10% of blue collar income. But recently, credit card debt has risen to 20% of blue collar income.

This can be fixed without easy money. We should not continue to try to “paper-over” our deficient economic fundamentals. Instead, we should work on our fundamentals, returning ourselves to the free enterprise system which made us great in the first place.

Reference

[30 years of economic stagnation in Japan] — https://www.npr.org/2024/04/03/1197958583/japan-lost-decade

[the hallucination of the illusory prosperity created by easy money (the phantom of cheap credit)] — https://mises.org/mises-daily/wages-unemployment-and-inflation

[blue collar workers] — U.S. Bureau of Labor Statistics, Production and Nonsupervisory Employees, Total Private [CES0500000006], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CES0500000006

[average weekly pay] — U.S. Bureau of Labor Statistics, Average Weekly Earnings of Production and Nonsupervisory Employees, Total Private [CES0500000030], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CES0500000030

[total credit card debt] — Federal Deposit Insurance Corporation, Balance Sheet: Total Assets: Loans to Individuals: Credit Cards [QBPBSTASLNINDVCRD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/QBPBSTASLNINDVCRD