In earlier posts here and here, I explored the reason that financial elites are trying desperately to take over the world and enact de-population and de-prosperity schemes. When “greed” is portrayed as the simple hope for a better life, it isn’t a bad thing. It isn’t a bad thing for you to want yourself and your family to prosper.

But the “greed” of financial elites is a different kind of greed: a greed for the unearned.

When what it is that you want is not something achieved by volitional trade to mutual benefit, but instead achieved by swindle, then the trickery and underhandedness required in order for you to continue to get ahead ends up shrinking the economic pie.

With a shrunken pie, those who had less now have even more pain and strife, and they might figure out that they’ve been swindled for decades. In order to preempt the consequent social disruption, financial elites can try to de-populate the masses before they figure out that their futures have been stolen from them.

Central Planning

Economics is the science of the allocation of scarce resources which have alternative uses. The intended purpose of economic science is to learn how to get ahead in life.

Karl Marx thought it’d be easy to get ahead, if people were dis-allowed economic freedom (the freedom to contract and trade with others to mutual benefit) but if, instead, central planners redistributed the resources “from each according to his ability, to each according to his need.”

To do central planning, government — not private citizens — must allocate most of the resources.

Deficit Spending

But income for the government comes directly out of productivity of the private sector, and there is a limit as to how much you can tax the money away from the private sector. To get past the limit, government bureaucrats discovered that if you get control of the money supply, then you can print the money that big government requires.

For a short time, this intentional inflation appears to work out well. But being able to work in the short-run isn’t evidence that the process can work out well in the long-run. In the long-run, you must “pay the piper” if you want to continue to “call the tune.”

And a side effect of ‘money printing’ is that it disproportionately grows the financial sector — i.e., those who “make money” as contrasted against the real economy of those who “make things”. When money is printed, it first goes into a bank (before it has had a chance to cause the prices to rise)

Hyper-financialization

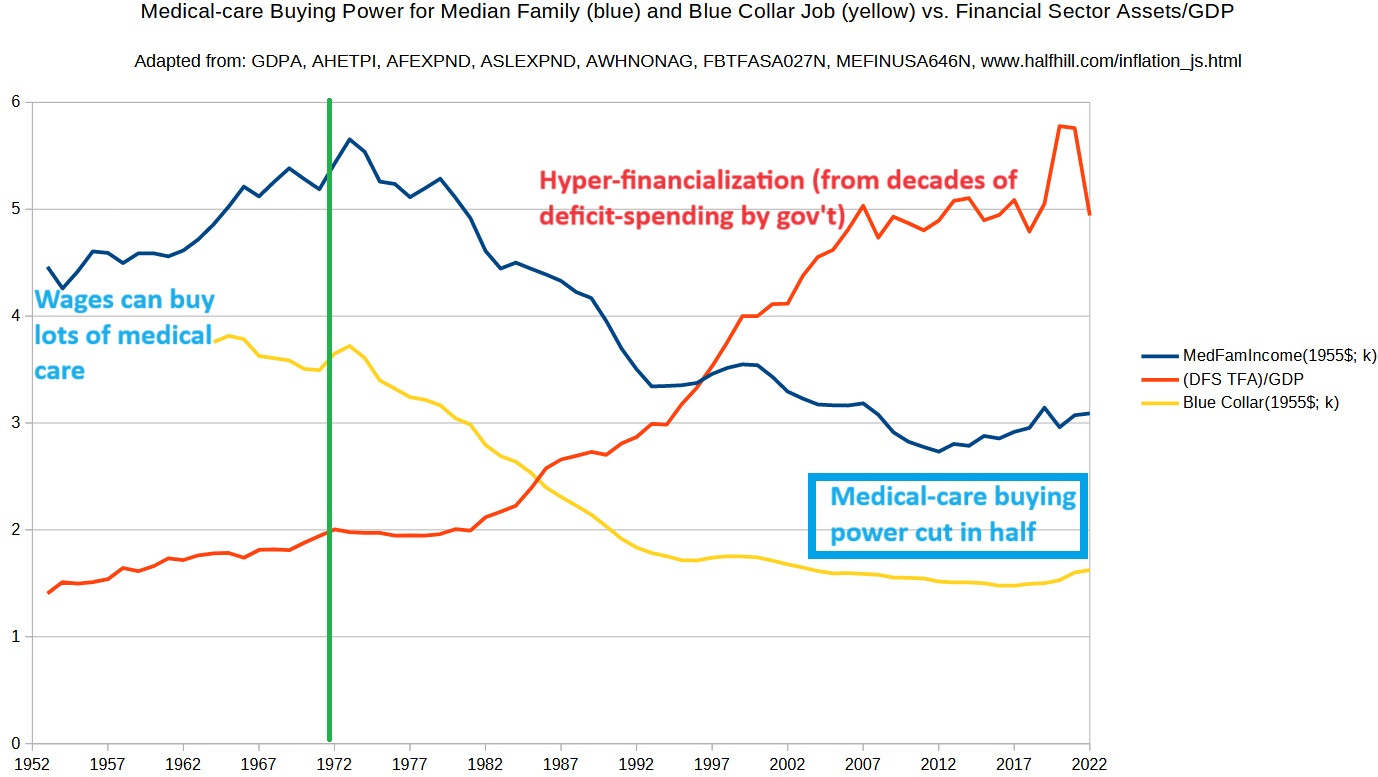

Hyper-financialization is when banks and other financial entities are disproportionately large, compared to the economy. When total financial sector assets are worth less than 2 times the GDP (left side of green line below), then it is easy for regular people to get ahead in life.

That’s because the finance sector, not yet lifted up by government deficit-spending, isn’t yet crowding out productive activity. But look what happens when the assets of the financial sector reach 500% of GDP:

The “free money” that bankers and bureaucrats grant to themselves with deficit spending ends up preventing regular people from being able to afford a high living standard — such as one that includes affordable medical care.

Great Reset

Because the “free money” ended up shrinking the economic pie, there is not enough to go around, and it incentivizes the financial elites to engage in de-population schemes and other schemes which lock-in lowered living standards for the masses (i.e., Great Reset schemes).

To sell the schemes, which are just a furtherance of the original swindle, finance moguls try to convince the public that they are necessary: such as to save the Earth from carbon dioxide, respiratory viruses, or ‘terrorists’ or whatever they need for an excuse to financially ‘rape’ the world.

But let’s make sure that we break out our ‘pepper spray’ and our ‘rape whistles’ — so that, if acosted by rapacious finance moguls, we’ll be able to escape their clutches.

People who have demonstrated that they are overwhelmed by greed for the unearned should not be allowed to get away with schemes which get them those unearned benefits while driving down living standards for the rest of us.

When there is strict enforcement of individual rights by a rule of law, then sound money, free trade, low government spending, and low government regulation all work together to grow prosperity.

Because we’ve strayed away from the rule of law, with government colluding with established businesses via surveillance, and with banks via monetary interventionism, we must now make a decision:

Either restore the rule of law and the economic freedom, or let financial moguls take over. The best part about it is that, if informed enough, we’ll get to decide.