Creating Recessions

Post #1451

While Mises was the first economist to unveil how it is that fractional-reserve banking creates an artificial boom in the economy — or a “bubble” — which then eventually results in a bust (a recession), Hayek expanded on Mises’ work with his “Additional Credit Theory of the Trade Cycle.”

When money is hard to get, then borrowing it usually comes at a high price in terms of the interest paid on the loan. Only the very best prospective business ventures get funded when money is hard to get — the ones that are almost guaranteed to pay off well. However, when money is easy to get, then every business idea is followed.

But there is a problem with following up on every single business idea: Some of them are really, really bad ideas that should have never been funded in the first place. When those ventures which should never have been funded go bust, then it starts a chain reaction (it starts a recession) — because too much capital has been mis-allocated.

So, to create a recession, just simply create too much money!

To find out how much is too much, you have to look at the growth rate in goods and services. If more money is created than the real growth of the real economy, you can get too much money chasing down dark alleys and rabbit holes and pie-in-the-sky ideas — eventually creating the next recession. Here is historic real growth:

As you can see, average real economic growth (growth in the number of goods and services) is somewhere around 3% per year, though interventionist government policy after 2007 has kept our growth down to an average that is below 2.5% (intervention kills growth). At 3% real growth, then 3% growth in money would be fine.

But what about 6% growth in “money?”

Notice how it is that, each time this measure of narrow money (M1) grows by 6% year-over-year, then we get a recession (shaded parts)? That’s because too much money was created too soon, leading into some really bad and outright stupid investments. In an easy money/cheap credit environment, good business ventures no longer dominate.

When the real economy grows by 3%, but money grows by 6%, expect future turmoil.

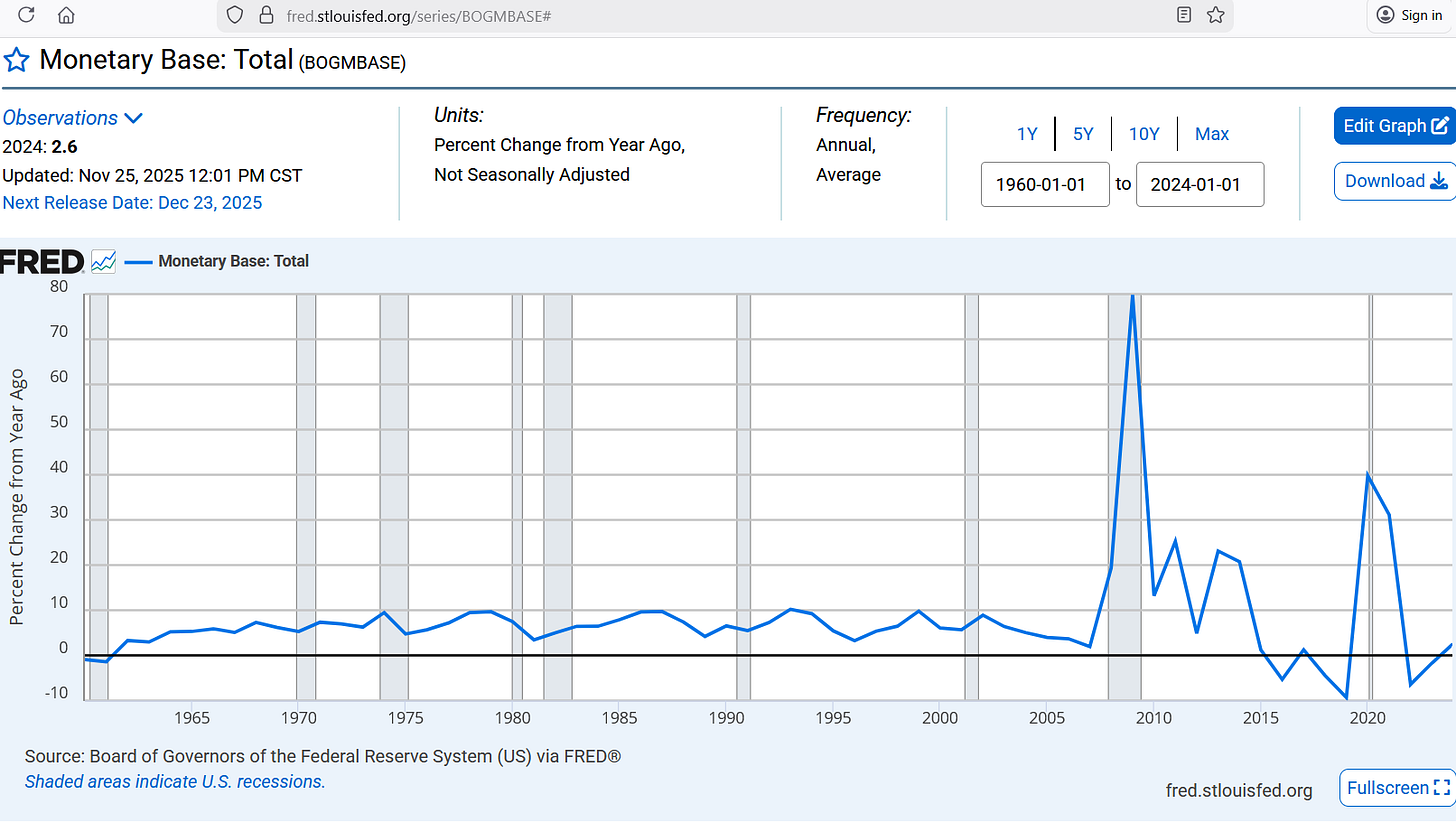

7% Growth in Monetary Base is “bad”

The monetary base adds all dollars held by the public (currency) to the dollars held by banks (reserves) and, because banks can hold onto a little more money without creating problems, it takes an extra percentage point of growth in the monetary base to bring on a recession:

Again, prior to each shaded area (each recession) you will find a growth rate of 7% or more precedes the recession. This is because growth in a real economy “cannot keep up” with a growth rate that high, and the excess cash finds its way into fruitless ventures, creating the ensuing recession.

To recap, 6% growth in currency and checkable deposits (M1) always preceded recessions, and 7% growth in monetary base always preceded recessions. But knowing that 6-7% is bad, look at how screwed up monetary policy has recently become:

Monetary Base — full timespan

In the Great Recession of 2007-2009, the big banks got bailed out and they were made flush with reserves, leading to an 80% jump in the monetary base in just one single year. This type of thing is guaranteed to create problems down the road though, as the slow growth after the Great Recession exemplifies (i.e., growth-killing intervention).

The COVID stimulus appears muted here, given the super-high injection of reserves into the big banks in 2009, but don’t let that fool you. The COVID response is every bit as unsound economically as the response to the Great Recession, as the yearly change in M1 shows:

M1 — full timespan

The money supply more-than-tripled (>200% increase) in 2020 compared to 2019, which represents a terrible insult to market mechanisms. If exceeding 6% is already a bad thing, then what are we to make of it exceeding 200%? This action is not “economic” — although it may be a form of criminality (may siphon off wealth).

The evidence suggests that uneconomical actions are being taken and that they are playing with our money and that there is no current respect for the free enterprise system which made our nation so great. It is as if the calf has grown into a cow, and now the unethical “money-changers” are planning to feed off of the carcass.

But this is how great nations die.

Reference

University of Groningen and University of California, Davis, Real GDP at Constant National Prices for United States [RGDPNAUSA666NRUG], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RGDPNAUSA666NRUG

Board of Governors of the Federal Reserve System (US), M1 [M1SL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M1SL

Board of Governors of the Federal Reserve System (US), Monetary Base: Total [BOGMBASE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGMBASE