Elections and Economy

Post #1497

The USA is in some real trouble if it does not achieve election integrity and an economically-sound foundation. Regarding election integrity, the most-secure method is election-day voting with regular, run-of-the-mill state driver’s licenses or a state ID, and hand-counted paper ballots. Though bold, that is the election reform, in a nutshell.

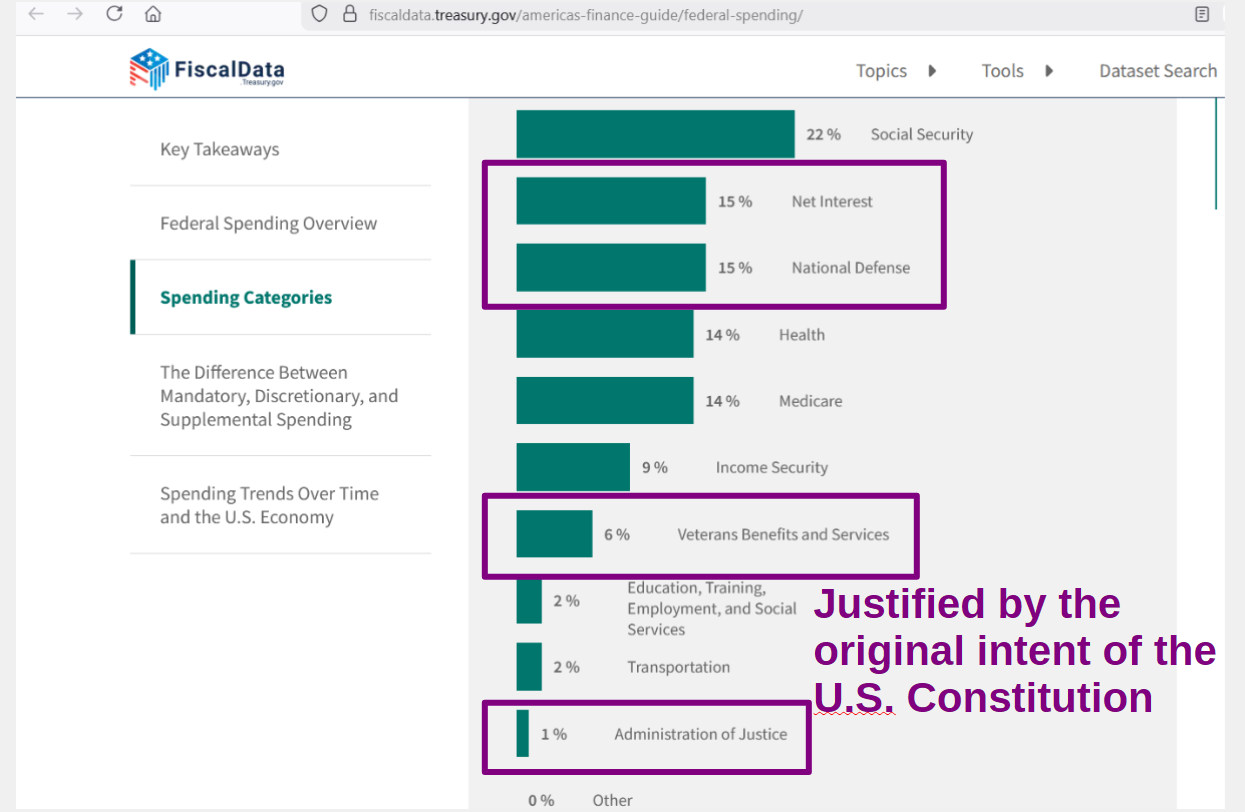

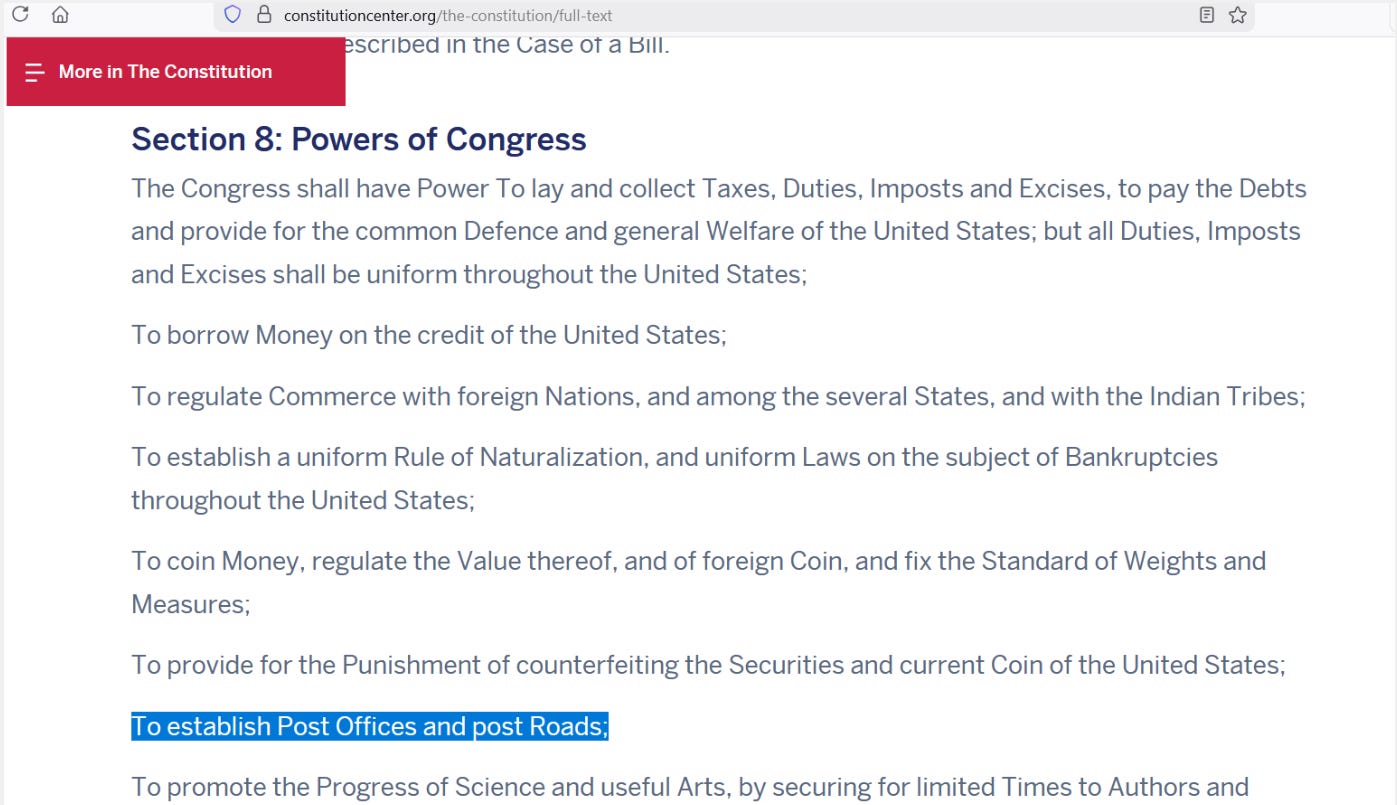

It bears mentioning that the primary push-back against hand-counted paper ballots may come from our own CIA and from adversarial foreign nations such as China (suspects in the fraud). To unleash the U.S. economy, federal downsizing — utilizing the original intent of the U.S. Constitution — is required (purple markings added):

Some debate can be had on peripheral issues, such as the enumerated power/authorization of the federal government to maintain postal roads (e.g., Dept. of Transportation) …

… but the big picture understanding is that approximately 37% of the spending that the federal government is currently engaged in is actually authorized by the U.S. Constitution.

Another way to put this is that the federal government needs a “63% haircut.”

After taking a haircut of 63% of the spending that it does — turning over all of the responsibility for that cut spending to the states (if they choose to take over that spending) — then a flat national sales tax would pay for the federal government. It is similar, but not the same as, the official plan called the Fair Tax.

With ~270 million U.S. civilians of age 16 and up, each one of them receiving $7,700 a year — because the universality of it prevents “gaming the system” — a flat national sales tax (“fair tax”) of somewhere around 15% would pay for the federal government. It shuts down the IRS and removes current obstacles to the needed Social Security reform.

The universal U.S. civilian yearly “prebate” check of $7,700 would allow the federal government to fully retire (abolish) the Social Security Administration, perhaps over the course of 100 weeks (700 days). The abolishment of the IRS may also be made to occur over the course of 700 days — with IRS employees given a 100-weeks notice:

The immediate implementation of a 1% weekly pay cut (using relative instead of absolute percentage drops) to all employees at the IRS should work out well. The first week, IRS employees will receive 99% of their usual pay. The second week, they will receive 99% of that 99%. By the goal of Week 100, the pay will be under 37% of usual.

In other words, making under 37% of usual pay, they will have chosen to leave the job.

Using only the adults of age 18 and up still represents a vastly broadened tax base and, along with the federal downsizing, allows for big tax rate cuts:

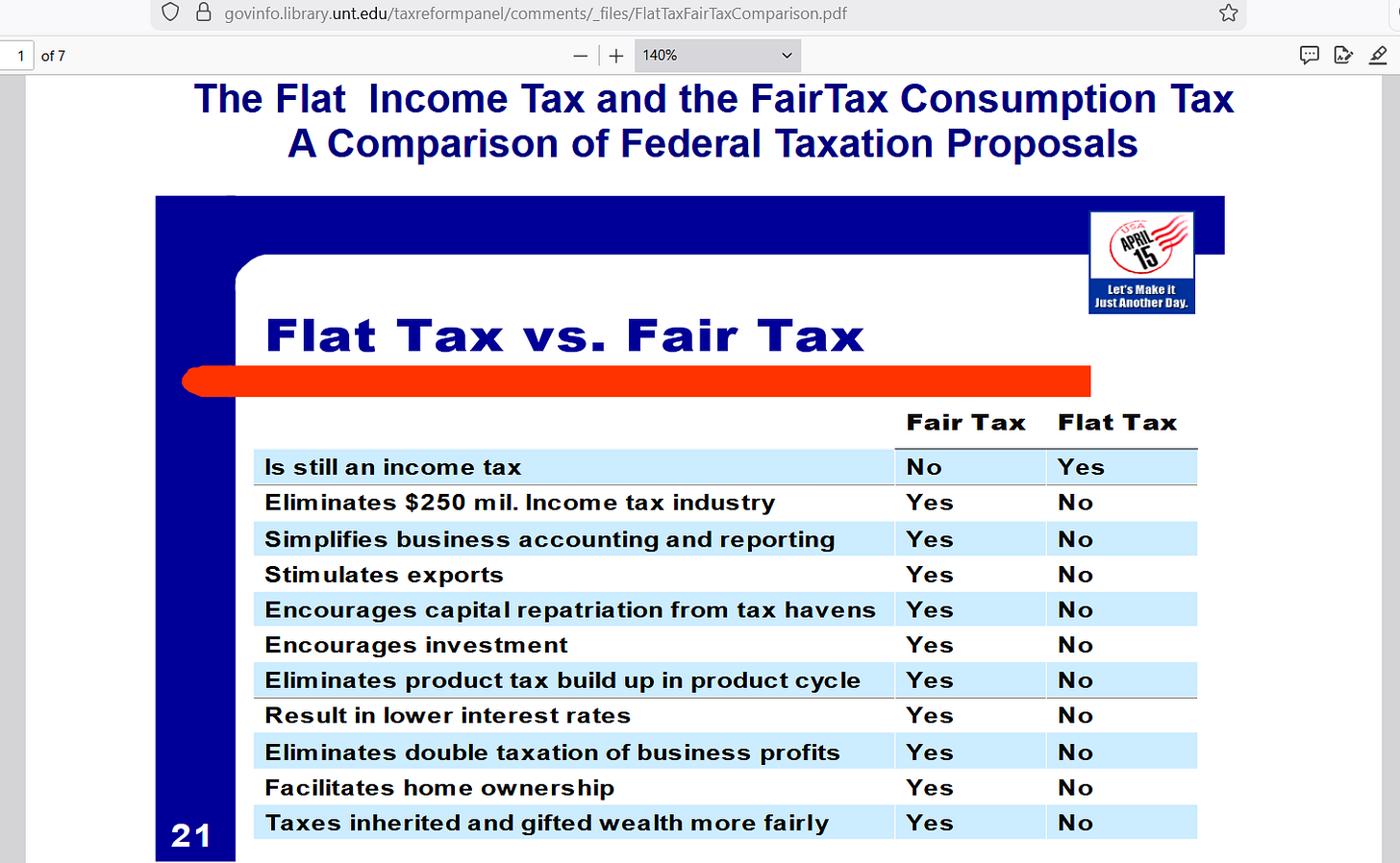

The flat national sales tax (“fair tax”) even has advantages over flat income tax:

Reference

[federal spending categories] — https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/

[full text of the U.S. Constitution, authorizing limited power to federal government] — https://constitutioncenter.org/the-constitution/full-text

[one version of the “Fair Tax” (a flat national sales tax)] — https://fairtax.org/about/how-fairtax-works

[advantages of an IRS-killing federal tax system] — https://govinfo.library.unt.edu/taxreformpanel/comments/_files/FlatTaxFairTaxComparison.pdf