Back in 2009 in Greece, something happened which led to a sovereign debt crisis, the Greek government was paying out social benefits which amounted to 20% more than the revenue than they were taking in, and — along with other waste, fraud, and abuse — the annual government deficit for 2009 reached 17% of GDP:

This value — a yearly government deficit worth 17% of GDP — appears to be a critical point, signalling an upcoming financial collapse and a sovereign debt crisis where the government can no longer obtain the funding to perform the services it had been providing to the people. In Greece’s case, the EU stepped in and bailed them out.

But look how expensive it got to sell long-term government debt in Greece:

In the month of February 2012, new issuance of 10-year government bonds had a stifling-high interest rate of 29%. This wasn’t the average interest that Greece was paying on its national debt, but just the interest on newly-issued debt for just that month. But the salient point is that Greece was getting bailed out at the time.

The bailout of Greece is the only reason why they were able to maintain government functions and bring the interest on newly-issued government debt back down to sustainable levels. No nation on Earth is rich enough to afford to pay 29% interest indefinitely (no productivity growth has ever been sustained at 29%, long-term).

But if this type of thing happened in the USA, then there would be no one to bail us out. Recently, the yearly government budget deficit has been rising by 3.7% of GDP per decade:

2015

2024

If we extrapolate this recent trend forward, then the U.S. federal government will “go bust” (reach the critical point of 17% yearly deficits) in 2051. In theory, because of being the reserve currency for the world, the actual break-point where the U.S. federal government goes completely insolvent may not be until yearly deficits hit 19% of GDP.

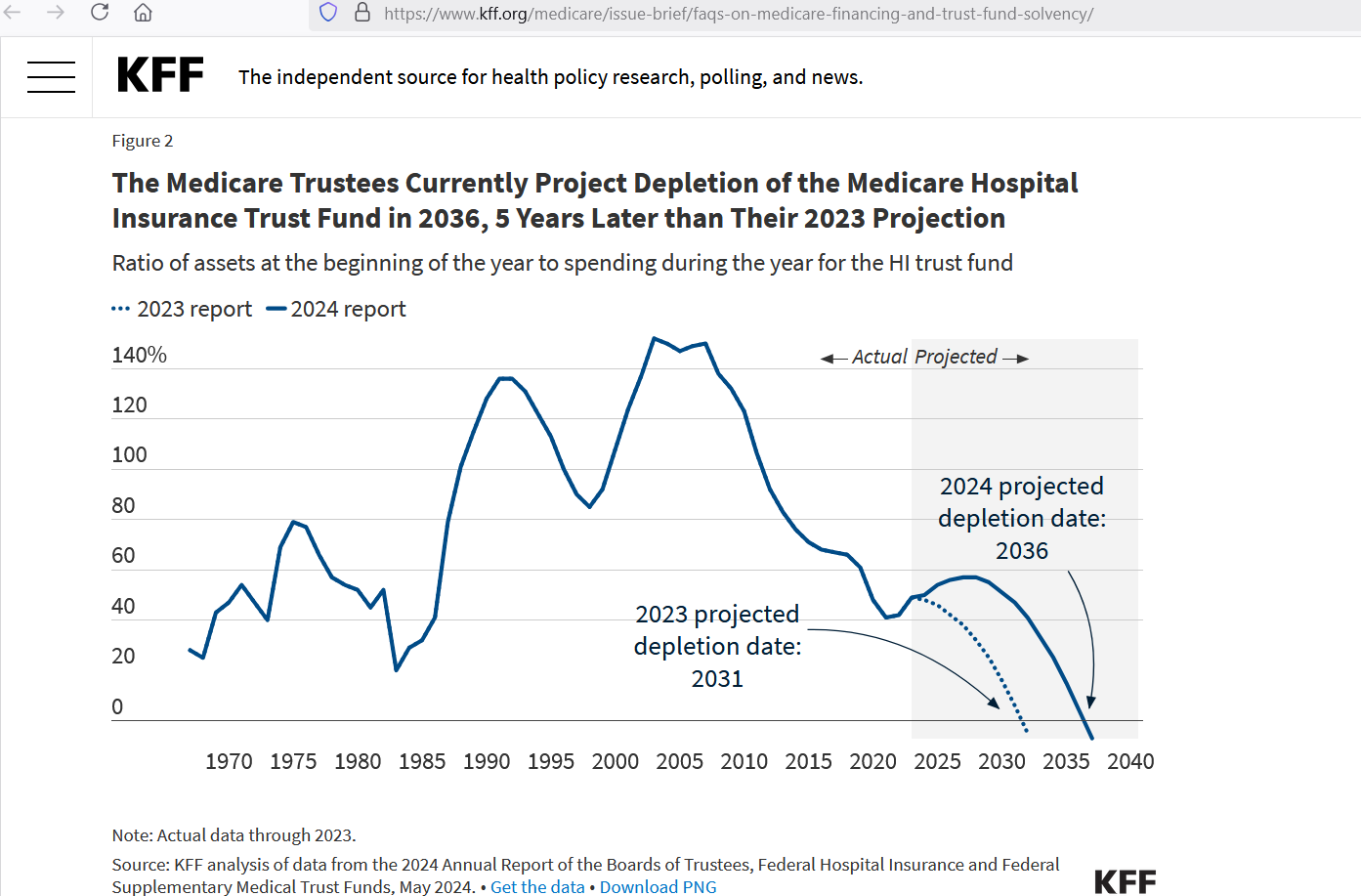

But the main point is that it is impossible for current trends to continue, even if there is political pressure to maintain current trends. Why have we not even returned to the pre-COVID level of federal government spending? It seems like the most sensible thing to do, but we have not done it. Social benefits like Medicare go broke in 11 years:

We need to Make America Great Again, but we also need to think long-term — so that we make America financially sound again (MAFSA), or, in other words, make our future bright again (MOFBA). We have been the Land of Opportunity for over two centuries, but let’s plan ahead in order to make sure that we can stay that way.

The most that the federal government needs to spend is 11% of GDP (the top federal government spending during the Great Depression), which can be entirely covered by a grand total of two taxes: a 15% flat national sales tax (~Fair Tax), and a 15% flat tariff on all imports (the IRS could be completely abolished if we use those two taxes only).

Reference

[the thing that sent Greece into a sovereign debt crisis was a defict worth 17% of GDP] — World Bank, Central government debt, total (% of GDP) for Greece [DEBTTLGRA188A], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DEBTTLGRA188A

[long-term interest hit 29% in Greece] — Organization for Economic Co-operation and Development, Interest Rates: Long-Term Government Bond Yields: 10-Year: Main (Including Benchmark) for Greece [IRLTLT01GRM156N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IRLTLT01GRM156N

[the current trend in federal defict growth is 3.7% of GDP per decade] — U.S. Bureau of Economic Analysis, Net Federal Government Saving [FGDEF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FGDEF

U.S. Bureau of Economic Analysis, Gross Domestic Product [GDP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDP

[in 11 years, Medicare goes broke] — https://www.kff.org/medicare/issue-brief/faqs-on-medicare-financing-and-trust-fund-solvency/