Our Stock Bubble

Post #1046

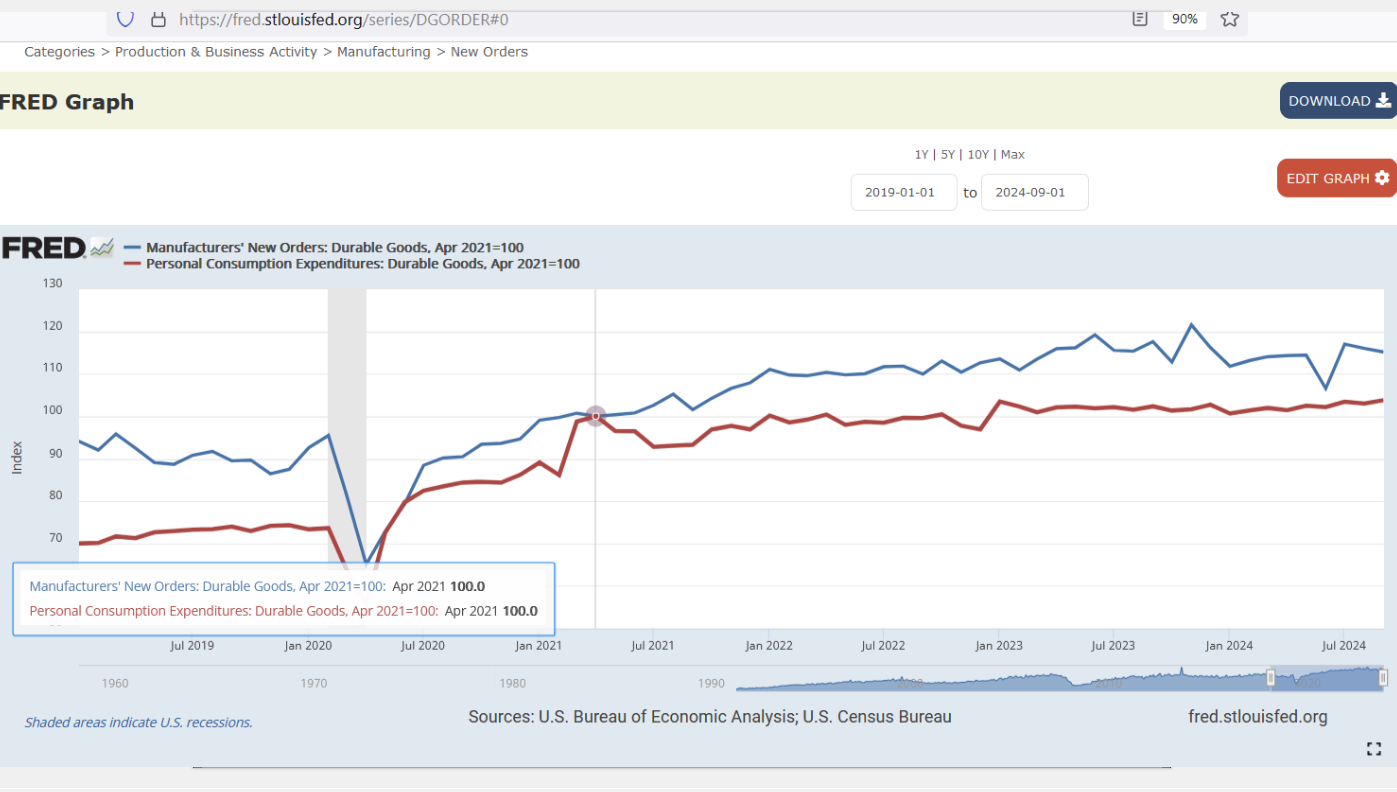

As I showed here, inflation killed the stock market (it no longer functions like it did). But here is more evidence that the stock market has detached itself from the real economy. First, check out how manufacturers’ orders for durable goods (blue line) went up by 15% over the 3.5 years or so from April 2021 to September 2024:

[click to enlarge]

That’s just 4% nominal growth, but during a time-span over which there was around 4% average inflation — in other words, that’s equivalent to zero real growth. Even worse is personal consumption of durable goods (red line), which rose by 4% over the course of 3.5 years or so — or 1% nominal growth during a time of about 4% inflation.

That’s negative real growth.

The S&P 500 was priced at about $4,200 in April 2021, but was about $5,800 by September 2024:

The price growth in the S&P 500 over those 3.5 years or so was more than twice as fast as the growth in orders for durable goods — and over 9 times faster growth than seen in the personal consumption of durable goods. We need a reset, but not the Great Reset that global financiers and bureaucrats envision. We need to restore sound money.

Reference

[orders for durable goods] — U.S. Census Bureau, Manufacturers' New Orders: Durable Goods [DGORDER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGORDER

[consumption of durable goods] — U.S. Bureau of Economic Analysis, Personal Consumption Expenditures: Durable Goods [PCEDG], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCEDG

[monthly S&P500 prices] — https://ycharts.com/indicators/sp_500